What is the Energy Bills Discount Scheme? Government support for energy bills explained

The Energy Bills Discount Scheme is the government's latest business energy support scheme, designed to help those struggling with rising energy prices. It replaced the Energy Bill Relief Scheme on April 1, 2023 but it's not a business energy price cap. Instead, it offers discounted unit rates on fixed-price contracts signed on or after December 1, 2021, as well as deemed and out-of-contract rates, subject to a minimum threshold.

Confused? Let us explain how it all works.

What is the Energy Bills Discount Scheme (EBDS)?

The Energy Bills Discount Scheme (EBDS) replaced the Energy Bill Relief Scheme (EBRS) on April 1, 2023. The new scheme offers a discount on non-domestic gas and electricity unit rates. The unit rate is measured in kilowatt-hours (kWh) and is the amount your business pays for each unit of energy it uses.

EBDS is available to non-domestic customers on fixed-price contracts that were agreed on or after December 1, 2021, as well as deemed and out-of-contract rates. But bear in mind that deemed and out-of-contract rates are usually higher than contracted rates, so it's worth comparing deals to see if you can save money with a fixed-price contract.

How does the EBDS discount work?

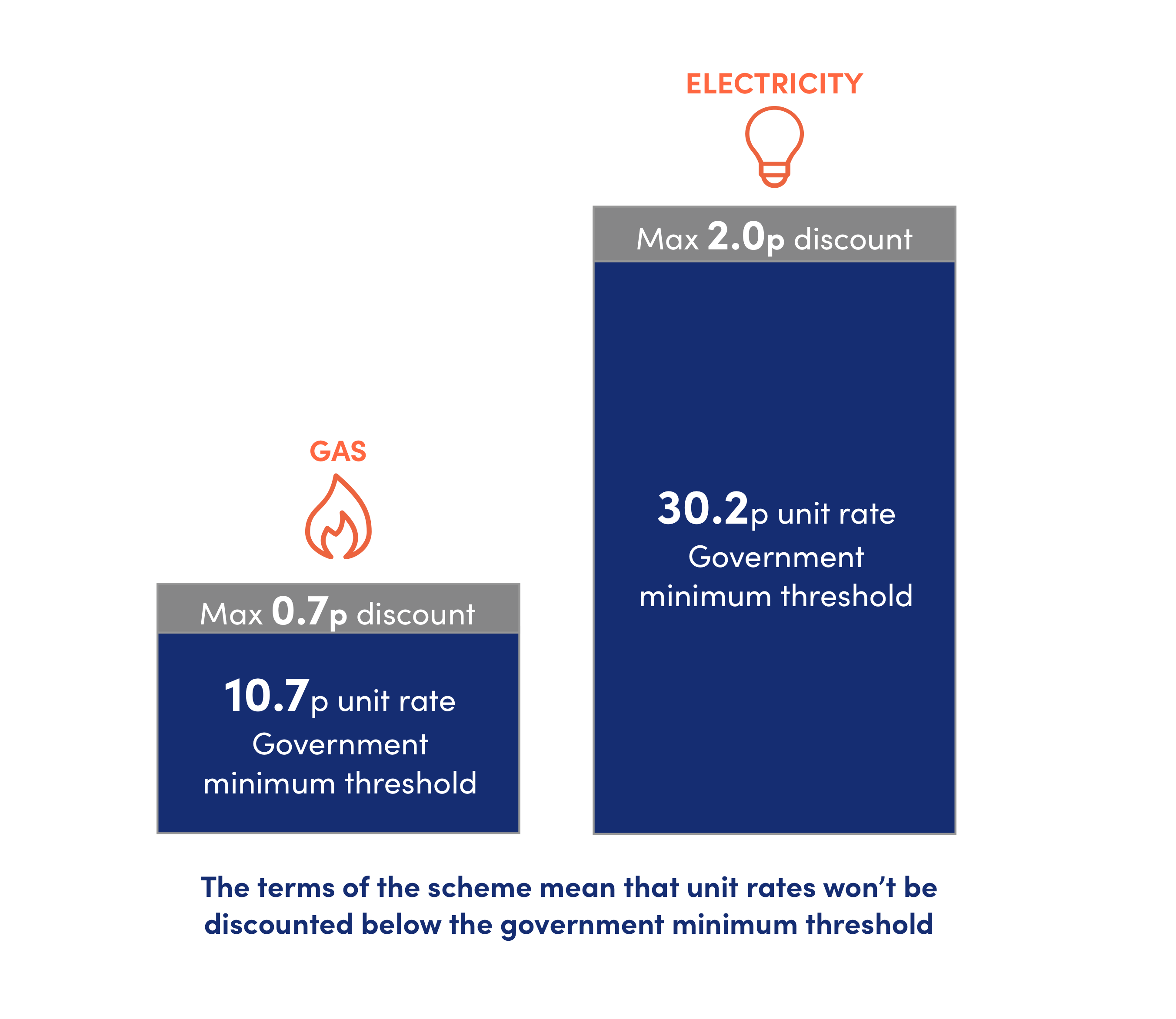

As with the current scheme, EBDS will offer a discount on the wholesale portion of your unit rates, so long as they're higher than a minimum threshold. Energy Trade Intensive Industries - those with a high energy consumption - will get a bigger relative discount than other businesses and the threshold price is lower.

Here's how it works for most business energy users:

- Gas – A maximum of £0.00697 (about 0.7p per kWh) off the difference between the wholesale element of the unit rate you pay to your business gas supplier and the price threshold of 10.70p per kWh.

- Electricity - £0.01961 (about 2.0p per kWh) off the difference between the wholesale element of the unit rate you pay to your business electricity supplier and the price threshold of 30.20p per kWh.

- The lowest rate you can be discounted to is 10.70p per kWh of gas and 30.20p per kWh of electricity. If your business is already paying this amount or less, it won't be eligible for the discount.

For Energy Trade Intensive Industries, which includes large business energy users like those in the mining and manufacturing industries (there's a full list of qualifying Energy Trade Intensive Industries on the government website), the scheme works like this:

- Gas – 4.0p off the difference between the wholesale element of the unit rate you pay to your supplier and the price threshold of 9.9p per kWh.

- Electricity – 8.9p off the difference between the wholesale element of the unit rate you pay to your supplier and the price threshold of 18.5p per kWh.

- These are maximum discount rates and will only apply to 70% of energy volumes, which means you'll pay full rates for the remaining 30% of the energy you use.

There's no need for most businesses to apply for a discount. As with the EBRS, energy suppliers will automatically apply reductions to the bills of all eligible non-domestic customers. But if your business is one of the listed Energy Trade Intensive Industries, then you will need to apply for the discount.

Ed Whitworth, Head of Energy Performance at Bionic, said: “Although less generous than the Energy Bill Relief Scheme, it’s good news that the government’s new Energy Bill Discount Scheme will offer universal support to businesses faced with high energy bills.

"Although available to all non-domestic customers on contracted, deemed, and out-of-contract rates, it’s still worth comparing energy quotes and locking in your rates. Fixing your rates will guarantee bill stability in what's still an uncertain market by locking in a consistent price for your energy. And, as with the Energy Bill Relief Scheme, the lower your contracted rates, the lower your discounted rates will be.”

Will the Energy Bills Discount Scheme save your business money?

If your energy contract is eligible then you will save money on your energy bills. But bear in mind that government funding for this support scheme has been cut quite significantly compared to the amount made available for the Energy Bill Relief Scheme.

Estimates put total funding for the Energy Bill Relief Scheme at around £18 billion over the six months from October 1, 2022, and March 31, 2023. But funding for the Energy Bills Discount Scheme will be capped at £5.5 billion over the 12 months from April 1, 2023, to March 31, 2024.

But what does that mean for your business?

Let's take the government example of a pub that uses 16 MWh (16,000 kWh) of gas and 4 MWh (4,000 kWh) of electricity a month. We'll say it signed a fixed contract in January 2023 and has a monthly gas bill of £2,976 and a monthly electricity bill of £1,796 (to keep it simple we'll leave out the standing charges as these aren't affected by the scheme). In this scenario, the pub would save £112 a month on gas and £80 a month on electricity. That’s a potential annual saving of £2,304 for both fuels.

Here's how the discount could break down:

How EBDS could affect business gas rates

| The fixed unit rate agreed with the gas supplier | 18.6p |

| Government threshold unit rate | 10.7p |

| Difference between the fixed rate and threshold rate (18.6p - 10.7p) | 7.9p |

| Discounted rate | 7.2p |

| The monthly bill before discount | £2,976 |

| The monthly bill after discount | £2,864 |

| The total saving on the monthly gas bill | £112 |

How EBDS could affect business electricity rates

| The fixed unit rate agreed with the electricity supplier | 44.9p |

| Government threshold unit rate | 30.2p |

| Difference between the fixed rate and threshold rate (44.9p - 30.2p) | 14.7p |

| Discounted unit rate (14.7p - 2.0p) | 12.7p |

| Monthly electricity bill before discount | £1,796 |

| Monthly electricity bill after discount | £1,716 |

| Total saving on the monthly electricity bill | £80 |

Note: The figures shown are based on the average gas and electricity unit rates quoted by Bionic for a microbusiness from January 3 to January 6, 2023. For more information on the latest energy rates, check out the Bionic blog on energy prices.

The discount is automatically applied to most eligible non-domestic energy contracts, but eligible Energy Trade Intensive Industries customers will have to apply for the higher level of support.

What if your contracted business energy rates are below the minimum threshold?

As with the Energy Bill Relief Scheme, you'll not be eligible for a discount if the rates you're paying are below the minimum threshold.

The discount you get depends on how much higher than the threshold rates your rates are, and it is only applied when the wholesale part of your unit rate is higher than the government threshold rate of 10.7p per kWh of gas and 30.2p per kWh of electricity. And you may not get the full discount if your rate reaches the maximum for that fuel before it can be fully applied.

For example, if the wholesale part of your unit rate is 31.2p per kWh hour, then you’ll only get a 1p discount as your rate will have reached the government threshold unit rate before the full 2p discount can be applied.

But if the wholesale part of your unit rate is 32.2p per kWh or more, you'll get the full 2p discount.

Is the Energy Bill Support Scheme (EBSS) different to the Energy Bills Discount Scheme (EBDS)?

The Energy Bill Support Scheme (EBSS) and the Energy Bills Discount Scheme (EBDS) are two separate schemes designed to help different types of energy users.

- EBSS was a government support scheme for domestic energy users. It provided £400 of support as a monthly discount on electricity bills between October 2022 and March 2023.

- EBDS is a government support scheme for non-domestic energy users. This replaces the Energy Bill Relief Scheme (EBRS) and will provide discounted unit rates on eligible business gas and electricity contracts from April 1, 2023, to March 31, 2024.

So far, so good. But what about the energy price cap and the Energy Price Guarantee?

What is the energy price cap for businesses?

There is no energy price cap for businesses. But there does seem to be some confusion over the government support schemes for household energy users (domestic) and business energy users (non-domestic), so let's try and clear that one up.

As we've outlined, the government has run two schemes to support business owners with their energy bills - the Energy Bill Relief Scheme (EBRS) and the Energy Bills Discount Scheme (EBDS). Both have offered a discounted unit rate on eligible non-domestic energy contracts, but neither is a price cap.

What other business energy support is available?

If the government scheme isn’t providing enough support, then you may be able to reduce your energy bills in other ways. In practice, this could be local grants or funding available to small businesses as well as making your business more energy-efficient and getting rewarded in return.

Find out more in our guide to help with your energy bills.

Should you fix your business energy rates?

Although we can't predict what will happen to energy prices, fixing your rates is the only way to guarantee bill stability by locking in a consistent price for your energy and the current discount.

That’s where the tech-enabled experts at Bionic can help. We’ll compare rates from a panel of trusted UK suppliers to get our best available fixed rates for your business. If you need to fix your rates, give us a call now on 0800 084 1830.

We can also help you compare deals for a range of business essentials, including insurance, phone, broadband, and VoIP.