How to understand your business energy bills and work out what the charges mean

Updated with the latest energy rates on July 9, 2025

Business energy bills can be tricky to understand, but it’s worth getting to know your way around them as they contain loads of useful information that can help you get an idea of your costs and figure out ways to cut your energy usage and save money.

Here’s more on understanding your business gas and electricity bills, including the main costs to look out for before you compare business energy deals and switch suppliers.

What is the average business energy bill in 2025?

Different businesses use energy in different ways and at different times. That's why it can be tricky to say how much an average bill should cost. But we've crunched the numbers for the year so far to come up with the average cost of an energy bill, based on the size and usage figures of an 'average' business.

Average business gas bill in 2025

| Business size | Average annual usage | Average annual bill |

| Micro business | 10,000 kWh | £918 |

| Small business | 22,500 kWh | £1,830 |

| Medium business | 47,500 kWh | £3,686 |

| Large business | 65,000 kWh or more | £5,545 |

Average business electricity bill in 2025

| Business size | Average annual usage (kWh) | Average annual bill |

| Micro business | 10,000 kWh | £2,717 |

| Small business | 20,000 kWh | £5,675 |

| Medium business | 40,000 kWh | £11,518 |

| Large business | 55,000 kWh or more | £13,545 |

For more information, read our guide on average business energy consumption.

Note: Prices are correct as of July 2025. Rates and bill size may vary according to your meter type and business location. The prices you’re quoted may be different from the averages shown. The figures shown are the average unit rates and standing charges quoted by Bionic per business size from January 1 to July 8, 2025.

How are energy bills calculated?

You might think energy bills are worked out by simply looking at the amount of energy you use in a month, but there's more to it than that. The amount you're billed each month will depend upon the following:

- The amount of energy you use - The number of kilowatt hours (kWh) of energy you use will be multiplied by the unit rate you pay on your current tariff. For example, if you use 100 kWh of electricity a month at a unit rate of 4.5p per kWh, you'll be charged £45 for that month's usage.

- The standing charge - This is a flat daily charge you pay regardless of how much energy you use. This rate will be multiplied by the number of days in the billing period. For example, if your standing charge is 45p per day and the billing period is a 31-day month, you'll pay £13.95 in standing charges.

- Taxes and levies - Additional charges like VAT and the Climate Change Levy will be added to your bill.

If you're eligible for discounts, such as the reduced 5% VAT rate, this will also be shown on your bill and work towards the total amount you need to pay.

What costs should you look out for on your energy bill?

The format of your bills can vary depending on who supplies your business gas and electricity. This can make it difficult to find the information that’s most relevant to you and your business, but three key sections should be included on most bills:

- A breakdown of how much you’ve been charged

- The amount of energy you’re using (measured in kWh)

- Your contract end date and information on your switching window

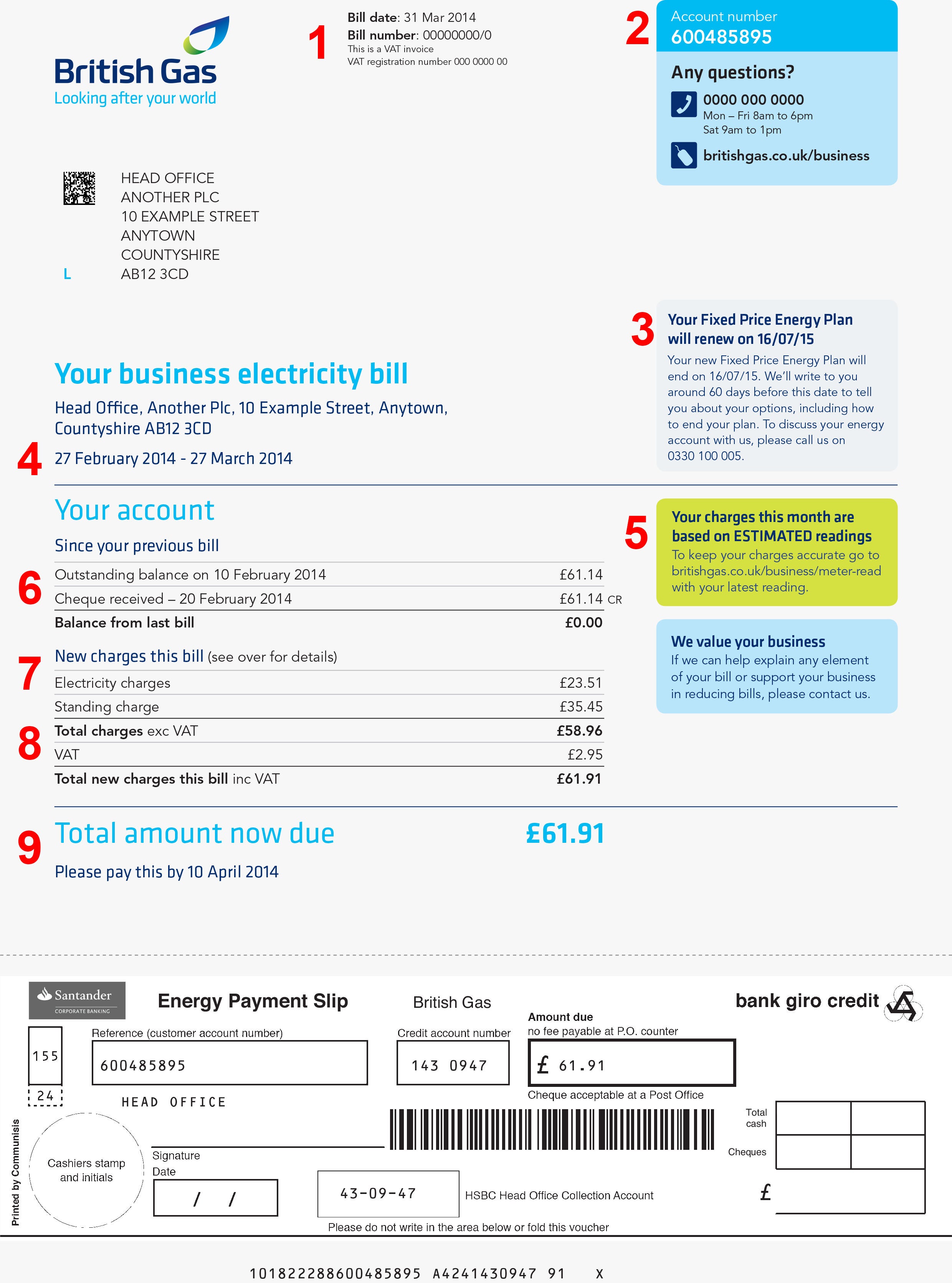

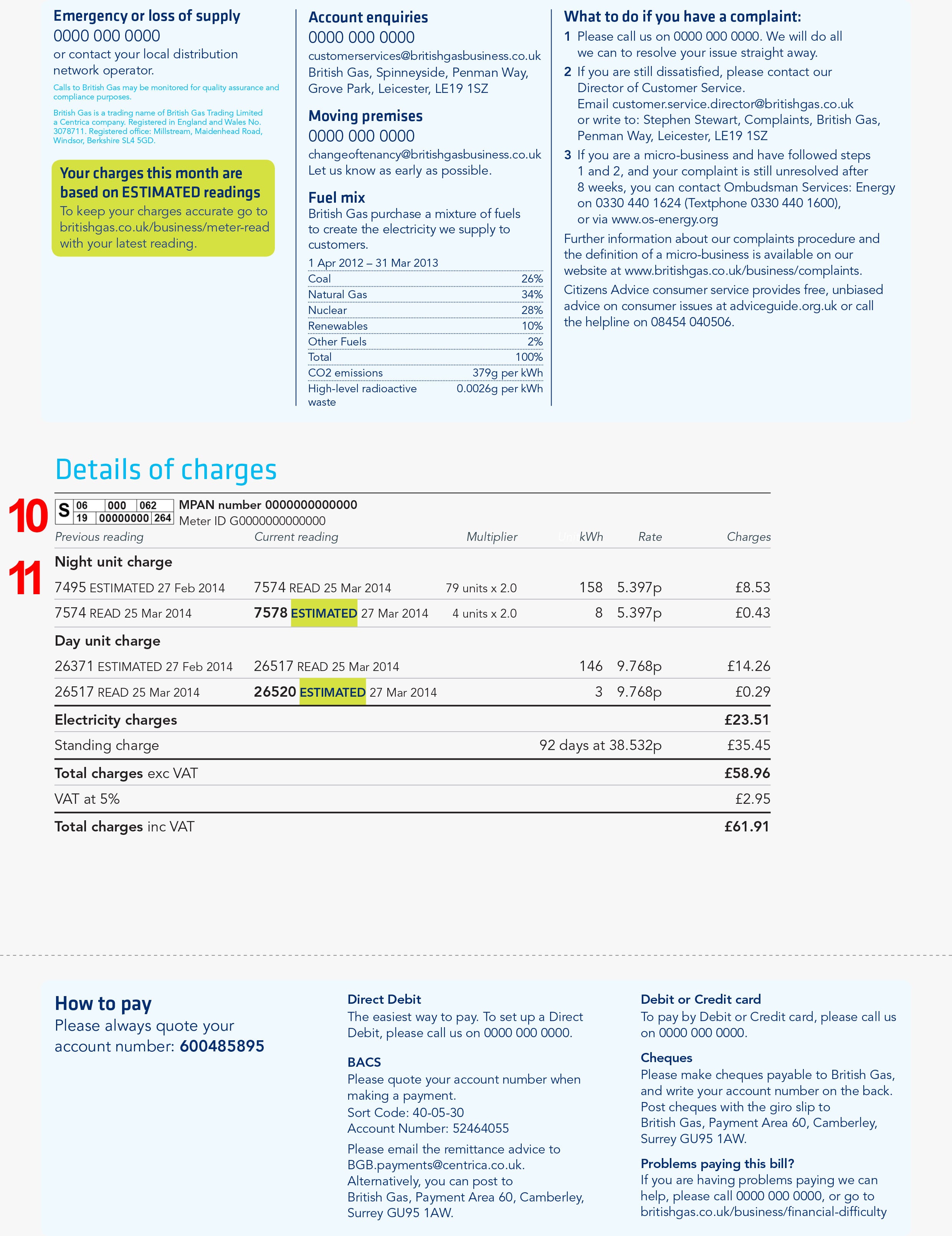

As a business owner, the amount you’re being charged for gas and electricity will most likely be your primary concern, so here’s an example British Gas non-domestic energy bill on which we’ve highlighted the costs that make up the total you pay each month.

If you’re with another supplier, your bill may be laid out slightly differently, but all of the same information should be on there. If not, you should get in touch with your supplier.

1. Bill date, bill number, and VAT number - Your account number can usually be found near the top of your bill. This is the number your supplier uses to identify you as a customer. It’s handy to make a note of this, as you’ll need it when contacting your supplier directly. The VAT number is the number that your supplier has on record for your business’s registered VAT number. If it isn't right, let your supplier know as you may be overpaying or underpaying VAT.

2. Account number and supplier contact details - This unique number is used to help identify your account. This section should also show your supplier's contact details. If you need to query any aspect of your account or make a complaint to your supplier, you can find their contact details on your bill. Most suppliers will also include separate contact details depending on your query type. For example, if you wanted to inform your supplier that you’re moving premises, a separate contact number should be listed.

3. Contract information - Somewhere on your bill, your supplier should indicate the details of your current contract, including:

- The name of the plan that you’re on

- When it is due to renew

- A contact number to discuss your plan.

Your supplier should write to you between 60 and 120 days before your contract ends to let you know it’s due to expire, but it’s always good to keep this date in mind so you have time to run an energy price comparison.

If you’re short on time, our tech-enabled energy experts can help, and take away the hassle of searching the market by doing it for you. They will compare the best deals from our trusted suppliers.

4. Billing period - This shows when your energy usage is being billed for. This is usually monthly, but may be quarterly.

5. Your reading type - Your bill can be based on two different types of reading:

- Estimated readings – Used if you don't provide your supplier with regular meter readings.

- Actual readings – More accurate, and based on a recent meter reading. If you’re on a half-hourly meter or smart meter, your bill will be based on accurate readings that are automatically sent from your meter to your supplier.

It’s worth noting that estimated charges can leave you paying too much or not enough, for the energy that you’re using. It’s recommended that you provide your supplier with actual meter readings at least once every six months, or preferably once a month.

6. Outstanding balance from previous bills - This figure indicates if you have any outstanding balance from previous bills, but be aware that this can vary depending upon the time of year. If, for instance, you set up a direct debit in the warmer summer months, when energy consumption levels will be lower, you might find that the amount you’re paying isn’t enough to cover your energy consumption in the winter. If this is the case, you can fall into debt with your supplier and might get hit with a huge bill to make up for the shortfall.

7. Balance from this billing period - This cost indicates how much you are being charged for the energy that you have used during this billing period. This is broken down into the following two charges:

- Unit rate - Measured in kilowatt-hours (kWh), this is the amount you pay for each unit of gas or electricity you use.

- Standing charge - This is a flat daily rate to cover the cost of getting the energy to your property and is charged regardless of whether or not you use any gas or electricity.

8. VAT charges - This shows the amount that has been added to your energy bill to cover VAT. This is charged at a rate of 20% but a discounted rate of 5% is available in some circumstances. This isn’t offered as standard so you'll need to check if your business is eligible. If your business is VAT registered, then you should be able to recover the VAT as input tax on your business expenses, subject to the normal VAT deduction rules. For more information, check out our guide to business energy and VAT.

9. Total amount owed - This is the figure that jumps out, especially if you’re on an expensive rate, as it shows how much you must pay in total, including your previous balance, charges from the current month, as well as VAT.

This section will also show the final date by which the bill needs to be paid. If you fail to make a payment by this date, then your supplier may add on a late payment fee. Keep in mind that paying your business energy bill by cheque, or post takes additional time, so you should keep this in mind when paying using these methods.

10. MPAN or MPRN number - The MPAN is a 21-digit number that can be found on your electricity bill, while the MPRN is between six and ten digits long and will be on your gas bill. You may also find your meter serial number on your bill, close to the MPAN or MPRN. If not, you can easily find this number on the meter installed at your premises. The MPAN, MPRN and meter serial numbers are all used by suppliers to quickly and easily identify the meter at your property.

11. Breakdown of charges - For a more detailed view of how your charges are calculated, your supplier should provide a detailed breakdown of your bill. As an example, consider a multi-rate contract where cheaper rates are offered during off-peak hours. In this instance, the breakdown will show how your usage is divided between the two different rates. If you find that you use very little energy during the cheaper off-peak hours, then perhaps there’s a better type of business energy contract suited to your business.

What costs are included in my business gas and electricity bills?

The two main costs that make up your business electricity and gas bills are the standing charge and unit rate.

What does ‘standing charge’ mean?

The standing charge is a fee that is charged daily to cover the cost incurred by the supplier to supply energy directly to your premises, as well as upkeep costs for the national grid. For more information check out our guide to standing charges.

What does ‘unit rate’ mean?

Measured in kilowatt-hours (kWh) the unit rate is a charge that covers each unit of electricity or gas your business uses. If you’re on a fixed rate deal, this charge is set at the agreed rate (meaning it won’t change as energy prices increase, as on a variable deal) but your bills will still fluctuate, depending upon the amount of energy you use.

The standing charge and unit rate are the two costs that you need to look out for when running an energy price comparison. They can be broken down even further, and doing so can help you better understand how they can impact your overall business energy costs.

The main elements that contribute to your unit rates and standing charge are:

- Wholesale costs - Part of your unit rate, this cost refers to the amount that business energy suppliers will pay to acquire the energy that you use. It’s worth keeping in mind that increases in cost on the wholesale market are traditionally passed on to customers. These increases are usually reflected through your cost per unit.

- Transmission use of system charges (TNUoS) - Your TNUoS charge covers the supplier’s expense for maintaining the national grid, which is used to transport energy to your premises. Generally encompassed by your standing charge, the cost of your TNUoS can vary depending on your business’s geographical location.

- Paying for distribution use of system (DUoS) - This charge covers the costs incurred by your Distribution Network Operator (DNO) – a company licensed to distribute electricity in your area – and includes day and night charges, as well as maximum supply requirements for larger businesses.

- Climate Change Levy (CCL) - The Climate Change Levy is a tax on each unit of energy that commercial customers consume. The levy is designed to encourage businesses to improve their energy efficiency and reduce their carbon footprint. It is possible to become exempt from the CCL, but this is subject to the level of action you have taken to improve your energy efficiency.

- VAT - VAT is added to your business energy bill by your supplier. VAT is usually charged at 20%, but it is possible to reduce this figure to as little as 5% of your business energy costs if you use less than 33kWh of electricity or 145kWh of gas per day.

- Feed-in Tariff (FiT) - The Feed-in Tariff (FiT) was introduced as an incentive to businesses and property owners who generate energy on-site through small-scale renewable electricity generation, such as solar panels and wind turbines. Ofgem, the energy regulator, charged energy companies a levy and this showed up as a separate payment on your bill. The Feed-in Tariff closed for new applicants in 2019, it's been replaced with the Smart Export Guarantee.

- Renewable obligation (RO) - The renewable obligation UK businesses are charged is one of a number of government initiatives to help meet climate change objectives by encouraging the development of large-scale renewable energy generation. Some suppliers will include RO as a pass-through cost which will appear as a separate item on your bills, while others will consolidate it as part of the overall supply rate you pay. Both these options are available to businesses with non-half hourly (NHH) and half-hourly meters HH) meters. RO was replaced by the Contracts for Difference scheme in April 2017, but existing RO contracts will continue to run until 2027.

- Contracts for Difference (CfD) - Brought in to replace RO, CfD costs are met by a levy applied to energy suppliers, which are then passed on to consumers as the following pass-through charges on your bill:

- Operational Costs Levy - A fixed unit rate per kWh that is charged to cover the running costs of the scheme set by the Local Carbon Contracts Company (LCCC).

- Supplier Obligation Costs - Based on the subsidy paid to each CfD generator according to the volume of energy generated and wholesale electricity costs, this covers the amount of low-carbon electricity funded by CfD. This is a variable charge that is estimated at the start of each quarter and amended accordingly at the end of the quarter.

- Quarterly fixed charges - Another fee that is calculated and revised as necessary, this is a fixed fee that’s paid each quarter to help negate the need for multiple reconciliations and complex calculations.

If your business gas is supplied by independent gas transporters (IGT), your bill will also show any associated IGT charges.

It’s also worth noting that failing to pay your business energy bills will impact your business's credit rating which could limit the energy deals you are eligible for in the future.

What affects the cost of your energy bills?

Things like standing charges, taxes, government levies, and the amount of energy you use all make up the total amount you pay for energy.

The price you pay for the energy you use can be affected by the wholesale cost of energy - that's the rate your supplier pays for the energy it provides to your business.

If you're on a variable plan, such as your supplier's out-of-contract rates, your prices will rise and fall according to market conditions. Remember, there's no cap on non-domestic energy rates, and out-of-contract rates are often much higher than those offered on fixed-term contracts.

Switching to a fixed-rate deal is the only way to avoid paying expensive out-of-contract rates and a good way to shield your business from price volatility.

Electricity generation costs can also have an impact. The higher the energy demand, the higher the generation costs. Electricity costs can change by the hour, and higher demand means energy generators cost more to produce power, and this can push prices up. That's why it can cost more to run appliances between 9 am and 5 pm, when demand is high in homes and businesses, than at night when less energy is used.

Even world events can affect the cost of your energy bills, as we saw with the price spikes that followed the conflict in Ukraine. For more information, check out our guide to business energy prices.

How to pay your business gas and electricity bill

The way you pay your energy bills can also affect the amount you pay overall, so it’s worth taking the time to consider how you pay for your energy and think about changing your payment method if it’ll save you money.

There are several different methods of payment (listed on your bill), including:

- Direct Debit - Direct debit is often the most convenient way to pay as the money is taken directly from your account. This means you'll never miss a payment (so long as there's enough money in your account to pay the bill). Some suppliers will also offer a discount for paying this way. If you pay by a fixed direct debit, it’s important to keep an eye on how much energy you are using. It may not cover the extra energy that your business may use throughout the colder winter months. It’s recommended that you review your direct debit amount at least once a year to ensure that it is still sufficient to cover your energy usage – failing to do so can leave your account in credit or debt.

- BACS - Some business owners prefer BACS payments instead of a fixed direct debit as it allows them to change the amount they pay month-to-month based on how much energy they have used. It means you’ll have to take action each time you need to pay your business energy bill, which can be time-consuming – but it also gives you greater control over your outgoings.

- Debit or Credit card - Many suppliers offer the option to pay via credit or debit card. To do so, you will need to contact your supplier’s payment department directly. This number can usually be found on your bill. Much like BACS, paying by this method means you must contact your supplier each time you wish to make a payment, which is not ideal for a busy business owner.

- Cheques or Giro - Another option is to pay by cheque or Giro slip, which can be found at the bottom of your business energy bill. These need to be sent by post to an address shown on your bill. It’s important to take into account postage – typically between three and five days prior to the final payment date – to avoid being hit with late charges.

Picking the right payment method for you can be as much about keeping costs down as it is about the convenience that certain methods can offer busy business owners. Contact your supplier if you feel another payment method may suit your business needs better.

Do businesses pay more for energy?

Although business energy and domestic energy are supplied through the same pipes and cables, sometimes by the same suppliers, you could find your business energy bills are higher than your household ones. There are two main reasons why businesses might pay more than households for their energy:

- They use more energy - no matter what your unit rate is, the more energy you use then the higher your bills will be.

- They pay more VAT - although there are exceptions, most businesses pay the higher VAT rate of 20% on business energy, compared to the 5% paid on domestic energy.

The best way to make sure you're not overpaying for business energy is to compare quotes from a range of suppliers and fix your rates. It's also important to line up a new contract to start when your current one ends to make sure you don't roll on to your supplier's more expensive out-of-contract rates.

There is no price cap on business energy and not fixing your rates could leave you with an expensive gap between contracts.

Why are your business gas and electricity bills so high?

The prices offered in a quote for business energy are known as acquisition rates and are generally offered to new customers. These prices tend to be more favourable to encourage people to become customers and the main reason why you can usually cut costs by switching suppliers.

There are many reasons why your energy bills could be high. The obvious one is that you're using too much energy, but there are other things to consider, including:

- You've been billed inaccurately - If you're hit with an unusually high energy bill, you need to first make sure that you've been billed correctly. If your bills are estimated by your supplier, they may not be accurate and you might be overcharged. To avoid this, take regular meter readings and send them to your supplier. It might be worth fitting a smart meter that sends automatic readings to your supplier.

- You're on deemed rates - If you move into new premises without arranging an energy deal there, the property's current supplier will place you on deemed rates. These are usually among the highest rates offered by suppliers and could lead to higher energy bills. If this is the case, speak to the team at Bionic to arrange a new contract. Deemed rates are priced this way to make up for the financial risk suppliers take when they supply energy to a customer who they know little about and have no record of their credit history or what the business does.

- You're on out-of-contract rates - If you let a fixed-rate energy deal expire then you'll be rolled onto your supplier's out-of-contract rates. These are usually higher than those offered on a fixed contract and could mean higher energy bills.

What if you can't afford to pay your energy bills?

If you can't afford your business energy bills, you should speak to your supplier as soon as possible to sort out a repayment plan. If not, your supply could be cut off. Although disconnection is usually the last resort for suppliers, the plug could be pulled on your power if you don't work out a way to deal with the debt within 30 days of your missed payment.

To make matters worse, disconnection usually comes with a fee that is added to the money you owe. If you're reconnected, you'll need to pay another fee.

Energy debt is considered a priority debt, which means it could be passed onto a debt recovery company. This can affect your business credit score and make getting future credit more difficult.

Whether you've been overcharged or you don't have the money to cover your energy bills, it's important to speak to your supplier as soon as possible to sort out the issue.

If you've been told your supply will be disconnected, give Citizens Advice a call on 0808 223 1133 or chat online with one of their energy advisors.

What to do if your energy supplier owes you money

If your supplier has been overbilling you (this can happen if your bills are estimated and you're using less energy than expected), then you can claim the money back from your supplier.

To claim your money back, you need to contact your business energy supplier and ask for a refund of any credit on your account. You'll need to give them a current meter reading to prove you've used less than they've estimated.

If they refuse or you're not satisfied with how they handle your refund, you can make a complaint. There's more info on how to do that in our guide - How to make a complaint to or about your business energy supplier.

If you're still not happy with their response, you can escalate the issue to the Energy Ombudsman.

How to switch business energy suppliers

To switch to a better business energy deal from Bionic’s trusted panel of suppliers, just give us your postcode and our tech-enabled experts will use smart data to find an energy deal that suits the unique needs of your business.

You just then need to give us the nod and we’ll take care of the rest - letting your old and new suppliers about the switch to make sure the whole thing runs smoothly, on time and with no disruption.

We’ll even keep an eye on your contract's end dates to make sure you’re never rolled on to your supplier’s more expensive standard rates. To become a Bionic business, just go to Bionic.co.uk and give us your business name and postcode or give us a call on 0800 970 0077.