How to cut small business costs as prices are rising

It’s been a tough couple of years for us all – just as we thought we were through the worst of the pandemic, we were hit with soaring energy costs and rising inflation. And we're still going through a cost of living crisis that's showing no signs of easing up.

This current economic situation is particularly tough for small business owners as rising prices are hitting both their personal and business budgets. Then there’s the worry that trade could drop off if people stop spending – a common effect of high inflation.

But how did we get here? How are small business owners dealing with rising costs? And is there anything you can do to ease the pressure of rising inflation? Let’s take a look.

30-second summary

- The cost of living crisis is particularly challenging for small businesses. Rising inflation, the energy crisis, government cuts for support and supply chain issues have all contributed to problems. Although inflation has fallen, prices are still high.

- Small businesses are facing rising costs for products, and materials as well as staffing and stock issues and slow supply chains.

- The economy shrank by 0.5% over summer 2023, which was more than experts were expecting. But as of May 10, 2024, the UK is no longer in recession.

- Business energy unit rates have reduced but are still double compared to 2021. The government has released several schemes to aid with the rise, including the Energy Bills Discount Scheme, but these have now ended.

- Businesses can combat the cost of living by increasing prices, cutting back growth plans, operating costs and staffing hours.

What is causing the cost of living crisis?

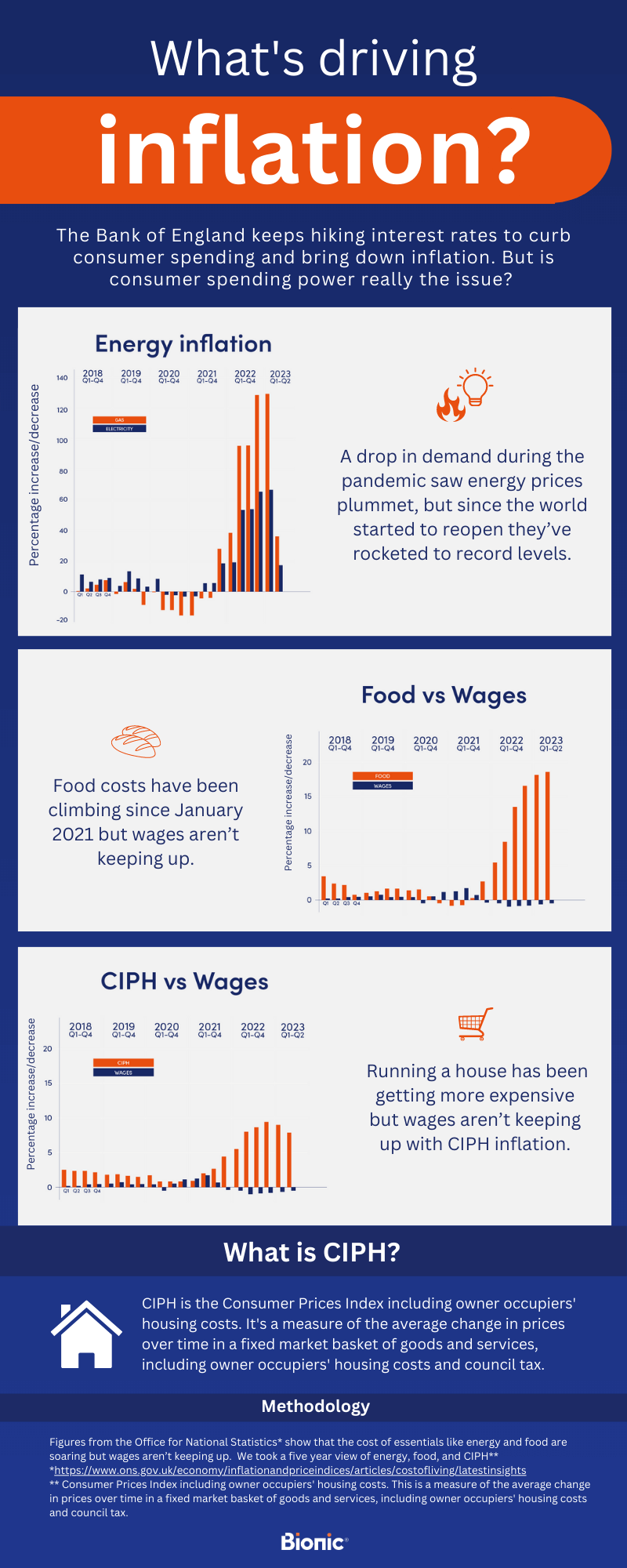

High inflation and low wage growth are the main reasons for the current cost of living crisis. When inflation is rising faster than wages and benefit increases, people have less money to spend on the things they need.

Inflation measures the rate at which prices are rising. An annual inflation rate of 4% means that a product that was priced at £1.00 last year will now be priced at £1.04. Something that cost £10.00 will now cost £10.40, and so on.

Here are some of the reasons why we are seeing a spike in prices:

- The energy crisis – Since the start of 2021, the demand for oil and gas has surged as more countries eased their way out of lockdowns. This high demand along with ongoing uncertainty over supply, caused by the conflict in Ukraine, has forced up global energy prices. And higher costs for energy companies mean higher costs for domestic and business energy users.

- Cuts to government financial support – The schemes for businesses have now ended and no further support has been announced. The government's Energy Bills Discount Scheme was not as generous as the Energy Bill Relief Scheme either. This cut in funding has caused problems for thousands of small businesses that have seen their bills increase dramatically since the new scheme began. The Federation of Small Businesses has estimated that around 370,000 small businesses could be forced to downsize, radically restructure, or even close down. Businesses have also started repaying CBILS and Bounce Back loans. This has led to higher costs for business owners, as has the cutting of other financial support, such as reduced VAT rates in hospitality.

- Goods shortages and supply chain issues – A reduction in shipping capacity (largely due to the pandemic) has caused supply chain issues and increased global shipping costs. The average cost of shipping a large container increased by 400% in the year to September 2021. Higher costs and higher demand, coupled with supply shortages, mean we’re continuing to be hit with higher prices. The conflict in Ukraine is also playing a part. Ukraine is a major exporter of agricultural commodities such as grain and sunflower oil, and disruption to these supplies is further pushing up global food prices.

You can get more detailed information on the above issues at the website of the Institute for Government - the leading think tank working to make government more effective.

As you can see, the conflict in Ukraine is playing a big part in global price rises as it’s causing disruption to manufacturing and agricultural supply chains, as well as pushing up energy prices.

And these energy price rises are playing a major role in the wider cost of living crisis. Figures from the Office for National Statistics (ONS) show that the wholesale price of gas contributed to around half of CPIH inflation in April.

The CPIH is the most comprehensive measure of inflation, covering all types of household spending along with all the costs of owning, maintaining, and living in your own home, including council tax.

To give you an idea of how much prices have increased year-on-year, CPIH increased by 5.7% in the 12 months to March 2023.

What does rising inflation mean for small business owners?

Rising inflation is usually framed as a bad thing for households, but increasing inflation means prices go up for everyone, including business owners. If you run your own business, this not only means you might need to pay more for materials, products, and stock, but it also means that employees might need a pay rise to compensate for an increase in the cost of living.

As demand increases, this can also cause supply chain problems and staff shortages - issues many business owners are experiencing because of Brexit and the pandemic.

If you trade overseas and UK inflation is higher than elsewhere, this can make you less competitive as your goods or services become comparatively more expensive.

But it’s not necessarily all bad news. You could see a surge in sales, particularly if inflation becomes long-term. This is because consumers might buy goods and services now rather than waiting over time and risking higher prices.

Is the UK currently in a recession?

The economy shrank 0.1% between July and September in 2023 and then by a further 0.3% between October and December the same year, which lead to a recession towards the end of the year.

To officially be in recession, there needs to be two consecutive quarters when GDP falls. (GDP is Gross Domestic Product is the market value of the goods and services produced by a country and is a measure of economic output).

But it looks like it hasn't lasted for too long, figures from the ONS show the UK economy grew by 0.6% between January and March 2024, marking the end of the recession.

Will prices drop if inflation falls?

No. Falling inflation doesn't mean falling prices. In fact, once prices have risen, it's unusual for them to ever come down again. Falling inflation just means that prices don't go up quite as quickly as they have been. Martin Lewis came up with a nice driving analogy to explain, saying: "It's a bit like the difference between a car's overall speed and its acceleration. If you slow the acceleration down, the car is still getting faster."

Wages need to keep up with inflation to lessen the impact of rising prices, but this isn't happening in many sectors and is a big reason why there have been so many strikes over the last 12 months.

As a small business owner, this can feel like you're being hit on all sides - the cost of running your business is going up, and your staff need more money, but putting prices up could drive customers away.

But what if prices did drop? Then this could cause deflation, which comes with its own set of problems. While we would all currently benefit from falling energy prices and lower food prices, if prices drop across the board then this can put people off spending. Even though they have more spending power, they may delay buying in the hope that prices fall even further.

This can mean less income for employers, which can lead to job losses, higher interest rates and, eventually, recession.

How are business owners feeling about the cost of living crisis?

Worry and uncertainty seem to be the overriding feelings for small business owners, with many feeling that the current crisis could have long-term consequences for their businesses.

Alison Rose, the boss of NatWest bank, has said that firms on the bank's books have falling confidence, while a PayPal study found that 52% of SME owners are concerned about future business uncertainty.

The PayPal study also found that a lack of consumer spending and rising fuel costs are seen as the biggest threats, but business owners have also cited other issues that are directly linked, including keeping cash flow steady (29%) and managing their own mental health (18%).

This study also found that two-thirds (66%) of Britain’s small business owners have found the last two years to be the most challenging they’ve ever experienced since starting out. Almost half (47%) are worried the next 12 months could be even more challenging.

These findings were echoed in Barclays’ SME Barometer, which found that 75% of small and medium-sized companies are worried about the long-term impact of the cost of living crisis.

We spoke to small business owners about how the cost of living crisis is affecting their day-to-day operations. Here's what they had to say:

- “The cost of living crisis has definitely affected us. The rise in supplies, food, staffing and energy costs have affected us greatly. Our running costs along with the drop in the number of people through the door are significant. I have noticed when I am out that hospitality overall has been affected. I expect this is due to more people having to tightly manage their finances and limit their social activities.” Kay Allen - Whiskers and Cream 🐈

- "The cost of living crisis is affecting us directly, every day. Almost all of our suppliers have put up their prices by at least 20% with some increasing by over 50%. Obviously, most utility costs have doubled over the last few years. My personal costs have increased through mortgage rates increasing, utilities, inflation etc, along with the other staff. Unfortunately, it really does seem to be the smaller businesses that take the final blow as they don't have the size to simply take the loss." Marcus Ackford - Pup Up Cafe 🐩

- "The cost of living crisis has had a big impact on my business, to the point where I’m having to give up my current premises and rent a room on a part-time basis and finance a cabin to be built in the garden to work from the rest of the time. My client base has declined by 80% since February. I’m hoping that once the warmer weather arrives and people's bills are lower that I might gain some clients back. Ever the optimist!" Alison Savage - New Moon Holistic Therapies 🌚

- "The cost-of-living crisis is having a significant impact on our business contacts such with suppliers increasing costs, wage increases and utility and rates increases. The costs also have an impact on our clients and how often they are able to visit for services and we are noticing them spreading out with longer gaps between appointments. The winter was difficult but there does seem to be more optimism in the air and hopefully, inflation starts to settle soon." Lilac Miller, Sleeping Beauty Salons 💅

- "Our immersive horror experience is very expensive to run, due to an actor-to-customer ratio of four actors for every seven guests. But, in an attempt to reduce the price of our tickets, we are introducing a daytime 'horror escape room' offering, called Horror House, which will monetize our venue during the daytime, which will eventually allow us to bring down the cost of our evening immersive experience 'Bloodbath' while still covering all of our staff and rental costs." Gary Stocker - Screamworks 😱

- "It has definitely changed the way I do things; I have a garden studio I love working in, but it can be expensive to heat. If I’m not going to be there - say I’m out co-working - I make sure I turn the studio heating off the day before. The crisis has made me more aware of the cost of everything." Abbey Booth - Stories With Clothes 👕

- "We are eternally grateful to still be in business, after 150+ years, and work every hour God sends to deliver. But we now spend much more time analysing our incomes, outgoings and comparing prices on every aspect of our business. We're really having to scrutinise every little detail which sadly takes us away from the shopfloor but means that we are as competitive in the marketplace as we can be.

It's been very challenging but not out of the ordinary. It's been interesting the last few years to see how the industry has pulled together and supported those within it to stay afloat, but also how some companies, suppliers and brands haven't.

Our customers are loyal, and we thank every single one of them for their custom, and we hope in due course to return to a more stable footing, but the years since 2016 have been so drastic, dramatic and difficult that it's hard to say when that might be. Whatever the future brings we're stronger, leaner and more efficient as a consequence but some peace and a little breathing space would be very welcome!” Martin Coles-Evans - Hargreaves of Buxton ☕

What is the government doing to help business owners?

The government rolled out the Energy Bill Relief Scheme, which discounted the unit rate on eligible non-domestic energy contracts for six months from October 2022. On April 1, 2023, this was replaced by the Energy Bills Discount Scheme, which ran until March 31, 2024. This worked differently from a price cap, the rates paid for gas and electricity were not capped.

This means that being on a fixed contract should work out cheaper than being on variable or out-of-contract rates. But it's worth noting that funding for EBDS was significantly less than for the Energy Bill Relief Scheme. And prices didn't hit the required threshold rate since December 2022 - months before the Energy Bills Discount Scheme kicked in. Both schemes have now ended and no further government support has been announced.

The government support for households works a bit differently. The Energy Price Guarantee was brought in to work alongside the energy price to help keep prices relatively low during volatile market conditions The Energy Price Guarantee was scrapped in July 2023 when a lower price cap meant that energy prices fell for the first time in around 20 months.

The scheme was designed to offer both households some bill stability but the unit rates and standing charges were capped, not the annual bill. This means that the more energy you use, the higher your bills would be.

How much have energy rates risen since 2021?

To give you an idea of how volatile energy rates have been, here are the average business energy rates from March 2021 (before the energy crisis), compared to the average business energy rates in September 2022, and April 2023.

Although prices have been on the way down, unit rates are still around double what they were in 2021 and standing charges continue to fluctuate. As

Average business gas unit rates per kWh

| Business size | Average price (per kWh) March 2021 | Average price (per kWh) September 2022 | Average price (per kWh) September 2023 | Average price (per kWh) September 2024 |

| Microbusiness | 4.2p | 30.2p | 10.0p | 7.6p |

| Small business | 4.1p | 30.2p | 9.5p | 7.4p |

| Medium business | 3.7p | 28.0p | 9.0p | 7.2p |

Average business gas standing charges

| Business size | Standing charge (daily) March 2021 | Standing charge (daily) September 2022 | Standing charge (daily) September 2023 | Standing charge (daily) September 2024 |

| Microbusiness | 31.0p | 32.3p | 96.4p | 43.8p |

| Small business | 35.0p | 40.0p | 58.1p | 44.3p |

| Medium business | 46.0p | 41.9p | 94.3p | 54.8p |

Average business electricity unit rates per kWh

| Business size | Average price (per kWh) March 2021 | Average price (per kWh) September 22 | Average price (per kWh) September 2023 | Average price (per kWh) September 2024 |

| Microbusiness | 17.3p | 83.3p | 29.4p | 25.9p |

| Small business | 16.9p | 82.8p | 28.6p | 26.1p |

| Medium business | 16.5p | 80.1p | 28.8p | 25.7p |

Average business electricity standing charges

| Business size | Standing charge (daily) March 2021 | Standing charge (daily) September 2022 | Standing charge (daily) September 2023 | Standing charge (daily) September 2024 |

| Microbusiness | 28.6p | 35.9p | 55.5p | 51.6p |

| Small business | 29.7p | 39.5p | 79.2p | 51.2p |

| Medium business | 29.4p | 35.0p | 89.0p | 61.5p |

Note: Prices are correct as of September 2024. Rates and bill size may vary according to your meter type and business location. The prices you’re quoted may be different from the averages shown. The figures shown are the average unit rates and standing charges on contracts sold by Bionic from September 1 to September 5, 2024.

How much is an average business energy bill?

The current market volatility and the fact that each business uses energy in different ways means it's difficult to say exactly how much an average business energy bill will be. But the number-crunchers at Bionic have come up with the following average annual bill amounts, based on rates quoted by Bionic this year.

To give you an idea of just how much prices have gone up over the last few years, we compare the average bill in March 2022 with the average in the following years.

What is an average business gas bill?

| Business size | Average annual business gas bill - March 2021 | Average annual business gas bill - September 2022 | Average annual business gas bill - September 2023 | Average annual business gas bill - September 2024 |

| Microbusiness | £533 (based on annual usage of 10,000kWh) | £3,138 (based on annual usage of 10,000kWh) | £1,352 (based on annual usage of 10,000kWh) | £920 (based on annual usage of 10,000kWh) |

| Small business | £1,050 (based on annual usage of 22,500kWh) | £6,941 (based on annual usage of 22,500kWh) | £2,350 (based on annual usage of 22,500kWh) | £1,827 (based on annual usage of 22,500kWh) |

| Medium business | £1,926 (based on annual usage of 47,500kWh) | £13,453 (based on annual usage of 47,500kWh) | £4,619 (based on annual usage of 47,500kWh) | £3,620 (based on annual usage of 47,500kWh) |

What is an average business electricity bill?

| Business size | Average annual business electricity bill - March 2021 | Average annual business electricity bill - September 2022 | Average annual business electricity bill - September 2023 | Average annual business electricity bill - September 2024 |

| Microbusiness | £1,834 (based on annual usage of 10,000kWh) | £8,461 (based on annual usage of 10,000kWh) | £3,143 (based on annual usage of 10,000kWh) | £2,778 (based on annual usage of 10,000kWh) |

| Small business | £3,911 (based on annual usage of 22,500kWh) | £16,704 (based on annual usage of 20,000kWh) | £6,724 (based on annual usage of 20,000kWh) | £6,059 (based on annual usage of 20,000kWh) |

| Medium business | £7,945 (based on annual usage of 47,500kWh) | £32,168 (based on annual usage of 40,000kWh) | £14,005 (based on annual usage of 40,000kWh) | £12,432 (based on annual usage of 40,000kWh) |

Note: Prices are correct as of September 2024. Rates and bill size may vary according to your meter type and business location. The prices you’re quoted may be different from the averages shown. The figures shown are the average unit rates and standing charges on contracts sold by Bionic from September 1 to September 5, 2024.

How can your business save money while inflation is rising?

It’s extremely difficult to cut costs and save money when the price of everything is going up – rising inflation means you get less bang for your buck. But there are some steps you can take to help ease the pressure, not all of which will be popular but will need to be considered:

Increase your prices

Putting up your prices to compensate for the higher costs you’re facing is the most obvious step to take. A British Chambers of Commerce survey of business managers found that most (92%) businesses felt under pressure to increase prices due to rising raw material costs. More than half (56%) were considering increasing prices to compensate for other costs, such as fuel and transportation.

But putting up prices does risk damaging your relationship with customers and lead them to look elsewhere. In a worst-case scenario, you may lose even more money than if you’d kept prices at the same level.

If you are going to put your prices up, think about it tactically – are there any areas where you can more justifiably hike prices or apply additional fees, such as specialist services or premium products?

Cut back on growth plans

At the turn of the year, small business owners had a fair bit of optimism where growth was concerned. Figures from the Barclaycard Payments SME Barometer show that, back in January, 40% of UK SMEs planned to hire an average of six new employees before the end of March.

But few industries managed to grow their businesses across 2019 and 2020, so now might be a good time to put off any expansion plans and keep that cash back for other priorities. Of course, every business is different, and you may need to grow to thrive, or even survive, but it’s something worth considering if money is tight.

Cut back on staffing hours

Cutting back on the number of staff you employ or the number of hours you can offer is the last thing any business owner wants to do. But there are times when all business owners need to make tough decisions. If it’s the only way to keep your business afloat, then it’s a consideration that needs to be taken seriously.

Remember that dismissing an employee is usually tough for all parties involved. And there are certain processes that business owners need to follow to ensure dismissals are fair. To find out more, check out our guide to dismissing an employee.

Cut your operating costs

When faced with high operating costs, it makes sense to audit your business to see where you can make cuts. This could mean swapping products or materials for less expensive versions. One obvious problem here is that this could affect the overall quality of your product or service, which could mean customers look elsewhere and you end up losing money and getting a dent in your reputation.

If the above measures are a bit too drastic, think about switching to cheaper service or stock providers, and make sure you’re not signed up for any subscription services you no longer use. It's also worth finding out if your business is eligible for tax relief. You can find out more in our guide to claiming allowances and tax breaks.

But there are ways to cut operating costs without affecting the quality of your offering – such as switching to better-priced deals on your business essentials. Although it’s difficult to find a domestic energy deal that can beat the price cap rates, the tech-enabled team at Bionic can compare business gas and business electricity deals that could beat your supplier’s out-of-contract rates.

We can also help with business insurance, business phone and broadband, VOIP, and business loans. We just need your postcode to start comparing deals. To find out more, go to Bionic.co.uk or call 0800 524 4122.