Why are energy prices so high? Are they still going up?

Energy rates have been relatively flat across 2025, with the odd increase and decline slightly affecting prices from week to week. But there's been nothing like the sharp rises and price volatility we saw in 2022.

But it still pays to keep an eye on the end date of your gas and electricity contracts to make sure you don't roll onto your suppliers' out-of-contract rates. These can be much higher than the rates you'd pay on a fixed contract.

But back to those energy prices. Although prices have levelled off following a huge spike and drop midway through 2022 and into 2023, they're still considerably higher than before the dramatic price increases.

And while a price cap has been in place since 2019 to keep household rates in check, there isn’t one (and there never has been one) for businesses. Instead, the government introduced a couple of discount schemes. The first was the Energy Bill Relief Scheme. This ran for six months from October 1, 2022.

On April 1, 2023, this scheme was replaced by the Energy Bills Discount Scheme. This ran until March 31, 2024.

As a business owner and householder, there are two things you need to consider:

- From April 1, 2025, to June 30, 2025, the energy price cap is set at £1,849 per year. This is up from £1,738 per year. It suggests energy prices are rising again. But remember, it's the unit rates that are capped, not the final bill. If you use more energy than the average household paying a dual fuel tariff by Direct Debit, you'll pay more than the cap level.

- There is no price cap on business energy. Although business energy rates might have fallen, prices aren’t capped, and there is no government support.

The rates you pay are largely based on wholesale prices in the live market. These prices change frequently and there's no way of predicting how prices will change. But the level of the domestic cap should give an idea of where prices are heading.

Although not connected to business energy rates, it does support the idea that prices are increasing. If your business energy deal is coming up for renewal, it's worth comparing prices to see what rates you can lock in.

Now let's take a closer look at why prices have been so volatile, what current rates look like, whether you should fix your rates, and more.

Five-point summary

- After huge spikes in 2022, energy prices levelled off across 2023 and 2024. However, they are still significantly higher than pre-pandemic levels — and experts predict they may not return to those lower levels for the rest of this decade.

- Unlike household energy, business energy prices have never been protected by a price cap. While government support schemes like the Energy Bills Discount Scheme helped in 2022–2024, there is now no ongoing support for business rates.

- Events like the war in Ukraine, lower renewable generation, storage shortages, and supply chain disruptions have all contributed to keeping energy costs high. Global gas prices and oil markets still have a big influence on UK energy bills.

- Energy suppliers buy energy in advance (hedging) to protect against volatility. This means current bills are often based on previously higher purchase prices. Suppliers also factor in risk, which keeps prices higher even as the wholesale market falls.

- The best way for businesses to protect themselves is to lock in a competitive fixed-rate contract before prices rise further. Energy-saving measures, smart meters, and comparing deals regularly can also help cut costs over time.

Why have energy prices been rising?

Energy prices fell steadily across 2023 and into 2024. The energy market has returned to a relatively normal state with none of the volatility we saw in 2022, and prices have stabilised. This was how things worked before Covid and before the price spike, as you can see from the graphs on the Ofgem website.

But before the market calmed, wholesale energy prices rose by more than 500% year-on-year, between August 2021 and August 2022. A relatively mild winter across the UK and much of Europe, coupled with the energy-saving efforts of homes and businesses worried by the prospect of unaffordable energy bills, helped to cut demand and caused a drop in prices across 2023.

The energy market was also hit by the shocks of Russia's invasion of Ukraine, the closure of Nord Stream 1, and other infrastructure issues. These events had a huge impact on prices, but this was lessened when European countries cut their reliance on Russian gas by filling storage facilities with liquified natural gas from across the globe.

Prices continued to fall across 2023 but have been steadily increasing across 2024. And even though prices have fallen, they're still around 50% higher than at the start of 2021. Wholesale prices are still higher than pre-pandemic levels, and the experts at Cornwall Insight, energy market intelligence analysts, have suggested that prices might not return to pre-pandemic levels this decade.

Although wholesale prices have fallen, energy is still very expensive.

Alex Staker, Head of Commercial Operations at Bionic, explains why these price drops aren't always passed on to customers: "It's to do with the way energy is bought and sold and the risk associated with this process. To be able to offer fixed rates, energy suppliers need to buy power in advance of selling it to customers. This means the rates at which they have bought wholesale energy to sell today might differ from the current wholesale rates.

"Suppliers also need to factor risk into their price calculations, in much the same way as finance providers factor risk into the prices they charge for credit.

"Energy suppliers are continuously buying energy to make sure there's enough to cover demand. If demand exceeds supply then they need to buy more at current market prices to cover the shortfall. But if supply exceeds demand, then suppliers need to sell the excess energy back to the grid - if the day-ahead price is lower than the price they bought the energy for, then they'll lose money.

"When the market is so volatile, the risk to suppliers is greater and so prices go up. And this is also part of the reason why it can take time and a consistent run of lower rates for any price drops to be passed on to customers."

How much are wholesale energy prices right now?

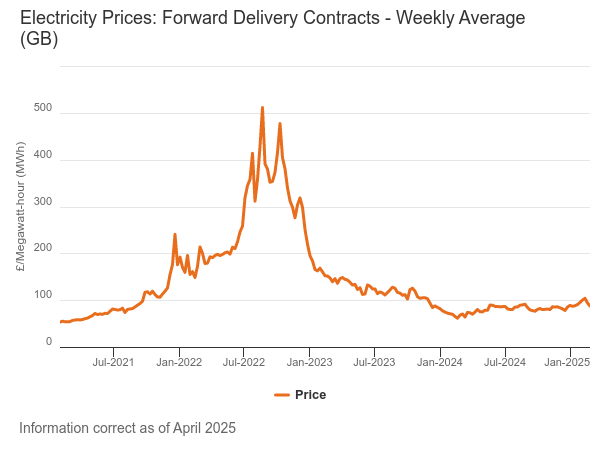

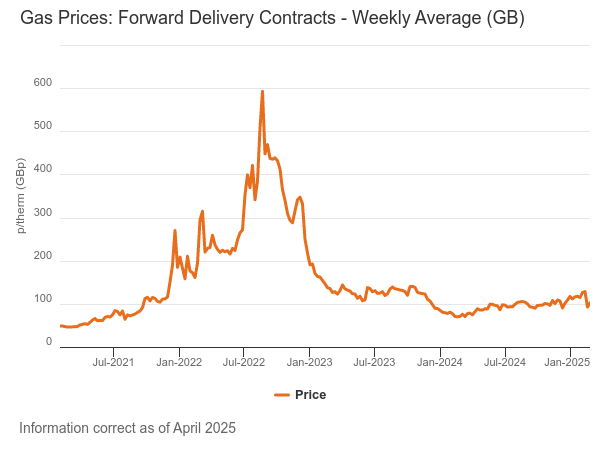

The latest Ofgem and ICIS forward delivery contract rates (which are the wholesale prices that suppliers typically pay for the energy they supply to customers) for gas and electricity are:

- Wholesale gas costs around 102p per therm* (around 29 kWh)

- Wholesale electricity costs around £88 per MWh* (1,000 kWh)

It's also worth checking the day-ahead contract rates. These show how prices change in the spot market (where energy is bought and sold to meet demand) and influence the forward delivery contract rates.

According to Ofgem and ICIS figures, the latest day-ahead contract rates are:

- Wholesale gas costs around 125p per therm* (around 29 kWh)

- Wholesale electricity costs around £105 per MWh* (1,000 kWh)

As you can see, day-ahead rates are considerably higher. This higher wholesale cost is reflected in higher variable and out-of-contract rates, which is why it pays to fix your rates.

What are the latest business gas and electricity rates?

The rates your business is charged for energy will depend on the size and type of your business, the amount of energy you use, and when and how you use it. The location of your business will also affect the rates you pay.

Visit our business gas and business electricity pages to learn each supplier's latest business gas rates and each supplier's latest business electricity rates.

Are energy prices still rising?

After a steep increase in wholesale prices during December 2021, prices remained volatile across 2022 and into 2023. But from December 2022, falling prices were the overall trend. This continued across 2023 but prices have increased steadily throughout 2024 and into 2025.

The graphs below from Ofgem's wholesale market indicators show how volatile gas and electricity prices have been over the last few years. Although prices dropped across 2023 and are no longer as volatile, they're now rising steadily. Gas prices are around double what they were in early 2021, while electricity prices are about a third higher.

Source - Ofgem and ICIS

But what was behind this unprecedented price volatility?

What causes energy price volatility?

Supply and demand are also big issues when it comes to price volatility. When energy is in short supply, prices tend to go up, but will usually drop again when supply levels are greater. And it's the same with demand - prices go up when demand is high, but usually fall again when demand is lower.

Price volatility has been a big issue since 2020, as normal supply and demand issues have been coupled with a series of global events that pushed up prices further. The role of the pandemic in causing huge global supply and demand shocks can't be underestimated. Neither can the impact of the war in Ukraine.

Price volatility is always a concern for energy suppliers, which is why they typically trade on futures markets to help increase certainty about supply and prices for consumers. This means suppliers can buy or sell a set amount of gas or electricity at a specific price, for settlement on a specific date in the future.

When prices are so volatile that suppliers find it more difficult to trade, they may have to provide extra collateral to cover the risk of supply shortages. This caused some suppliers to pull out of providing prices when rates spiked in 2022. With no commercial cap in place, some suppliers increased out-of-contract gas rates by an average of 180%, and out-of-contract electricity rates by an average of 130% during this period.

Here’s why these wholesale rates affect the price we all pay for gas and electricity:

- Suppliers buy energy from the wholesale market and then sell it to domestic and business energy customers

- When wholesale prices go up, energy suppliers increase their rates to cover the extra costs and we’re all hit with higher energy bills

Switching to a fixed-rate deal will protect you against any mid-contract price rises, but you’ll probably find your rates will rise at the next renewal.

Why are energy prices so high?

Supply and demand issues push up wholesale energy prices (that's the amount your provider pays energy generators for the gas and electricity they supply to your business). And rising wholesale costs are often the biggest factor in rising energy prices. Here are some reasons why UK energy prices shot up and remain the highest in Europe.

- Lower renewable energy generation - Low winds, coupled with outages at some nuclear power stations, mean that a higher percentage of our electricity generation is using gas during its production. If you're on a green energy deal that provides 100% renewable electricity, you'll still see your rates increase. This is because the way the UK energy system works means that the price of renewable energy is tied to the price of gas - if gas prices go up, so do renewable energy prices.

- Low gas reserves - The UK has some of the lowest gas reserves in Europe, which means there’s almost no way of stockpiling gas to use it when needed. Capacity is equivalent to roughly 2% of the UK’s annual demand, compared with 25% for other European countries and as much as 37% in Europe’s four largest storage holders.

- Insufficient government support - Although the government's £15 billion support package will see households credited with £400 over six months from October, this won't have as big an impact as measures taken in other European countries. France, for instance, has capped electricity price increases to 4% until the end of the year.

- Issues with the energy market - 34 UK energy suppliers have gone bust since 2021. This is largely down to many of them having a business model that couldn't cope with an increase in wholesale prices. And when suppliers go bust, consumers help to absorb the cost through higher bills. For instance, when Bulb ceased trading, it was such a big supplier - providing power to around 1.5 million homes and businesses - that the government placed it into 'special administration' instead of going through the 'supplier of last resort' process. Initial estimates suggested this process would cost £2.2 billion over two years, but figures from the Office for Budget Responsibility (OBR) show that an extra £4.6bn has been spent on handling the company, which will bring the total to £6.5 billion. This could add as much as £200 on to annual household energy bills.

UK energy prices are also affected by global events.

How do global events impact energy prices in the UK?

The UK doesn’t operate in a bubble when it comes to energy. Global events — from political tensions to extreme weather — can quickly ripple through to your gas and electricity bills. Here’s how it happens.

- Global gas prices - The UK imports a lot of gas, especially liquefied natural gas (LNG) from the US, Qatar, and Norway. When global supply gets disrupted — by wars, sanctions, or bad weather — the price of gas soars.

Because gas powers a big chunk of our electricity, higher gas prices often mean higher energy bills. For example, the Russia-Ukraine conflict cut Europe’s gas supply and sent UK prices soaring, even though Britain wasn’t a major buyer of Russian gas. - Oil prices push up costs - Oil plays a smaller role in UK energy generation, but it still matters. When oil prices rise — for example, due to OPEC production cuts or tensions in the Middle East — transport and supply chain costs climb too. In some cases, gas prices are linked to oil, meaning costs can rise together.

- Extreme weather disruptions - Storms, droughts, and freezing winters can damage energy infrastructure or boost demand overnight. A cold snap across Europe - like the Beast from the East in 2018, for example - can drain gas supplies and force prices up across the UK.

- Supply Chain Setbacks - Pandemics, shipping delays, and global crises can hold up new energy projects, like offshore wind farms or gas terminals.

When there’s less supply on the market, prices stay higher for longer. - Currency Fluctuations - Energy is priced globally in US dollars. So if the pound (£) falls in value, it costs more to import gas and oil. Those higher costs can trickle down into your bills.

- Market Volatility and Speculation - Global traders react quickly to headlines, not just facts. Speculation about shortages or political risks can spike energy prices before anything even happens. This volatility filters through to the UK’s wholesale market, driving supplier costs higher.

- Life after lockdown - An increase in demand as lockdown restrictions eased across the globe. There's more on that in the section below, titled: How did the pandemic affect energy prices?

How did the pandemic affect energy prices?

Let's quickly go back to the first lockdown of early 2020, when a drop in demand saw energy prices drop to their lowest ever levels. Although wholesale prices had been dropping since hitting a high of £67.69 per Megawatt-hour (MWh) in September 2018, things bottomed out at just over £24 per MWh in April and May 2020 - at the height of the first lockdown.

Prices steadily increased late 2021 when we saw some massive spikes. An increase in demand was a big driver of the price hikes.

A greater need for energy since the crash of spring 2020 saw gas prices increase more than five-fold and return to pre-pandemic levels.

For the wholesale electricity market, there has been a reduction in available power supplies compared to last year which, combined with higher gas prices, has led to an increase in the wholesale price of electricity.

An increase in network and policy costs also pushed prices up.

Higher electricity distribution and transmission costs have driven a rise in network costs, as has an increase in policy costs, such as the Renewable Obligation (RO). For reference, the RO is a levy placed on all licensed electricity suppliers to encourage them to source a proportion of the electricity they supply from renewable energy sources.

The pandemic also saw more energy suppliers hit by 'bad debt' and many lost money because customers simply couldn't afford to pay their energy bills.

Why are renewable energy prices so high?

If you're on a green deal that offers 100% renewable energy, you might be wondering why your prices are shooting up even though no gas is used to generate it.

It's all because of the way the UK's energy system works. Although renewable energy accounted for more than half (50.5%) of the UK's total energy generation between July and September of lastyear, we still rely on gas-powered plants to generate some of our electricity.

And that's where the pricing issues come from. Energy prices are set using a system called 'marginal cost pricing'. In short, this means that the most expensive type of energy is used to set the price for all types of energy, including renewables.

Even if you're on a plan that delivers 100% renewable energy, the price of your electricity is set not upon the cost of wind or solar generation, but on the cost of the last source used to meet demand. As gas-powered stations are used to top up electricity demand in the UK, so the cost of gas-powered electricity is used to set the price of all electricity.

So, when gas prices spike, you can bet that electricity prices won't be far behind.

Renewable and nuclear power has been moved off marginal pricing and onto Contracts for Difference. This means the cost of renewable and nuclear-generated energy is no longer tied to gas prices. Instead, generators will get a fixed, pre-agreed price for the low-carbon electricity they produce during the time the contract is running.

This de-coupling of costly global fossil fuel prices from electricity produced by cheaper renewables should help ensure consumers benefit from cheaper prices when switching to lower-cost, clean energy sources.

You can find out more in our guide to how energy is bought and sold in the UK.

Will energy prices go down in 2025?

It's hard to predict energy prices at the best of times, but the current market volatility makes it impossible to say whether energy prices will go down this year.

Forecasts from Cornwall Insight, energy research and analysts, suggest that energy prices will fall slightly in April and October 2025 but they are unlikely to drop significantly.

Should you fix your energy prices in 2025?

Fixing your energy rates is the only way to get bill stability in an unstable market and protect against future price rises. Although we can't predict what energy prices will do in 2024, market volatility calmed significantly in 2023, and prices dropped across the year. If the market stabilises and there are no more shocks, we could see prices slowly rise again as they tend to during 'normal' inflationary conditions.

If you're unsure what to do, give our energy experts a call on 0808 253 7101. We only need your postcode to run a price comparison of rates from our panel of trusted UK suppliers.

What if you can't afford to pay your energy bills?

If you can't afford your business energy bills, you must speak to your supplier as soon as possible to sort out a repayment plan. If you don't work something out with your supplier within 30 days of your missed payment, they can start action to disconnect your energy supply.

For more information, check out our guide to business energy bills.

Will energy prices ever come down?

Energy prices crashed towards the end of 2022 and into 2023 and continued to fall throughout that year. But as the market calmed in 2024, they slowly started to rise again. This is normal, but prices are still a lot higher than before the pandemic.

What can you do to keep your business energy bills low?

The only way business owners can currently shield themselves from out-of-contract rates and any potential future price rises is to lock in existing rates as soon as possible.

To get a quote tailored to meet the needs of your business, give our tech-enabled experts a call on 0808 253 7101 or pop your postcode in the box on our business energy page and we’ll give you a callback.

If you want to help cut your business energy bills, it also helps to think about how and when you’re using gas and electricity. So, consider the following:

- Assess when you’re heating your premises

- Switch appliances off

- Pay attention to the weather

- Install a smart meter to save

- Be mindful of water costs

- Turn off lights when not in use or fit light sensors

- Encourage all staff to be energy-aware

- Draught-proof your building

- Go paperless as much as you can

- Request an energy audit

For more detailed information, check out our blog on how to save business energy (and money).

But you also need to be realistic. Even if you put in place all of the energy-saving measures possible and cut your usage right down, there’s still a minimum amount of energy you need to use to keep your business running, so you might still feel it on your balance sheet if your energy rates rise.

Can I predict my energy bill?

You might think that, in theory, you could predict your energy bill before you receive it. But it’s more complicated than just figuring out how much energy you have used because taxes and levies are also added into costs.

To find out more about how to read your business energy bill and calculate costs accurately read our guide to understanding business energy bills.

Things to think about when choosing an energy deal

Not all business energy tariffs are the same - if you choose the wrong one, your business will pay too much for gas and electricity.

And because signing up to a business energy deal means you're locked in for the duration of the contract, you could be paying too much for anything up to five years.

This might leave you wondering whether it's worth bothering at all - here's why it definitely is worth comparing business gas and business electricity deals.

If you’ve never switched business energy suppliers, your current provider will have you placed on an expensive ‘out of contract rates’ deal, which can cost up to twice as much as contracted rates (even more in the current market).

When switching, you'll need to bear in mind that the rates you're offered will depend on things like the amount of energy you use, the location of your business premise, and whether or not your business is in good financial shape - a poor credit score could see you paying higher rates, as your business is seen as a higher risk.

It's also worth knowing that business energy suppliers don’t offer dual fuel deals, so even if you agree to a gas and electricity deal with the same supplier, these will still be two separate energy contracts.

How to switch business energy suppliers

The quickest and simplest way to find the best business energy deals is to speak to the tech-enabled human experts at Bionic.

Just give us your business name and postcode and we'll use smart data and our own expertise to find the best business gas and business electricity tariffs for your business in a matter of minutes.

To get started, pop your business postcode in the box at Bionic.co.uk, or give us a call on 0800 086 1326.

Our business energy experts will then search for the best deals from our panel of trusted and quality UK energy suppliers, then help you choose the right energy tariff over a short call.

You just then need to decide which deals you like best, and we’ll take care of the rest. And there's no need to worry about renewals either, as we can find you the best deals year after year.