A guide to working capital loans for UK businesses

Whatever your business, it is likely that you will need some sort of financial support at some point. That is why understanding business financing is so important for all small to medium business owners.

But different types of business finance suit different types of business, which is where Bionic can help - whether you need a working capital loan, asset financing or a long-term lending solution, we can guide you through the process and find the best possible deal for your business.

What is a working capital loan?

A working capital loan or a business capital loan is a type of business loan for SMEs. They tend to be short-term loans lasting up to 12 months and are used to cover day to day spending rather than a major investment. They can be either secured or unsecured loans depending on your circumstances.

Business working capital loans are often relatively quick to arrange, which can be useful if your business runs up against unexpected short-term cash flow problems.

What is working capital?

Working capital defines how much cash your business has available to spend safely at any given time. It's essentially the money your business has available to cover all of its short-term expenses that are due within the next 12 months.

In financial terms, it is the value of your current assets minus the cost of your current liabilities. Your current assets are defined by your cash holdings in addition to any assets that can be converted into cash and any invoices that are due for payment within a year. Conversely, liabilities are any debts or tax bills that are due for payment within a year.

Your business capital is therefore likely to go up and down over time - which is why a working capital loan for a small business could be useful.

How is working capital calculated?

To calculate the working capital available to your business, you need to subtract its current liabilities from its current assets.

A positive number means you have enough cash to cover short-term expenses and debt. A negative number means you don't have enough money to cover your outgoings.

What is positive net working capital?

Positive net working capital is when the value of your business's assets is greater than its current liabilities. This means your business has enough money to pay all its expenses. Here's an example of positive working capital:

- Cash in your business bank account = £35,000

- Money owed to suppliers = £10,000

- Money owed in salaries = £15,000

- Net working capital = £10,000

What is negative net working capital?

Negative net working capital is when your business's liabilities are higher than the value of its assets. This means there's not enough money to cover its debts. Here's an example of negative working capital:

- Cash in your business bank account = £35,000

- Money owed to suppliers = £25,000

- Money owed in salaries = £15,000

- Net working capital = -£5,000

What is a good amount of working capital?

A ratio of between 1.2 and 2.0 is considered a good amount of working capital. To calculate the working capital ratio of your business, you need to divide the total amount of current assets by the total amount of current liabilities. For example:

- Current assets = £35,000

- Current liabilities = £25,000

- Working capital ratio = 1.4

If your working capital ratio falls below 1.0 then this points to negative working capital. If it goes above 2.0 this could suggest your business isn't making the most of its assets. In either case, it's worth getting professional financial advice.

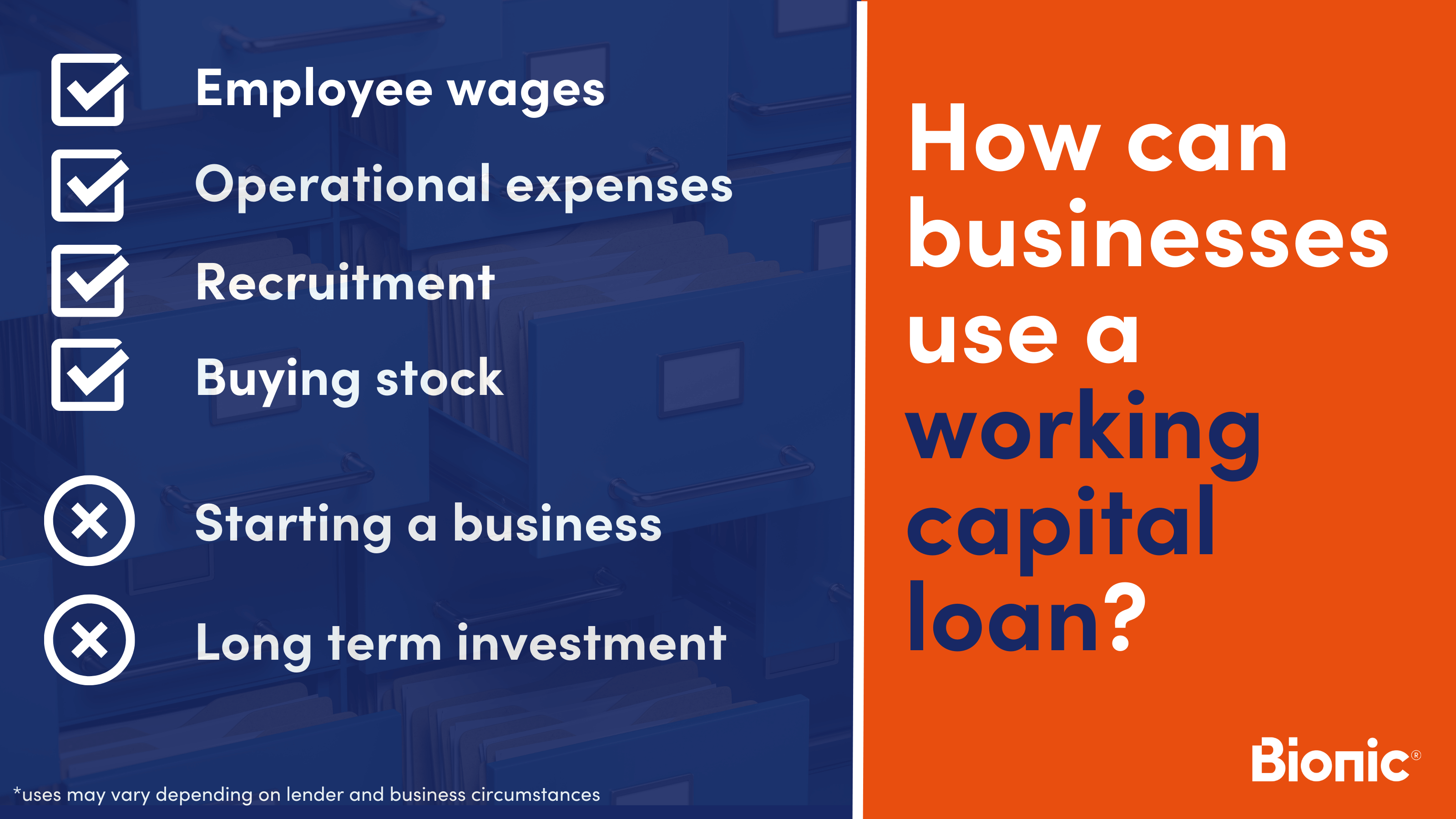

What can working capital loans be used for in the UK?

UK businesses can use working capital loans for a wide variety of purposes. Some lenders will tell you specifically what you can and can’t use working capital loans for, but the most common uses are to cover day to day business expenses such as staff wages or rent on your premises, or to cover seasonal shortfalls in revenue.

They are also often used to pay for stock or equipment. However, for larger purchases, other forms of financing - such as a business loan - may be more appropriate. You also cannot use working capital loans to start a business in the UK, in this case, you’ll need to look into start-up loans.

How do working capital business loans work?

Working capital loans for small businesses are relatively straightforward compared to other types of business financing available to SMEs.

Although it depends on who you approach for your business funding, certain UK lenders will offer working capital business loans of up to around £500,000 and will tend to ask for some form of security (in other terms an asset owned by the business) to “secure” the loan. They are generally short-term loans, lasting up to a year. Repayments are made in monthly instalments with a fixed interest rate agreed at the outset.

Can I get a small business working capital loan?

Many types of businesses can apply for a working capital loan, including small businesses and micro businesses. Whether you are accepted for the loan depends on your individual circumstances as you’ll still need to meet the lender’s eligibility criteria. This usually includes conditions related to the annual turnover of your business, its trading history, the type of business, and your own credit history.

What are the pros and cons of working capital loans?

The main advantage of a business working capital loan is that it can often be arranged quickly, meaning the money can be in your account within days or even hours. This means you can shore up your finances in next to no time to resolve short-term cash flow problems or take up new business opportunities.

Working capital finance is also very easy to understand. Repayments are over a short time frame and interest rates are set out from the start, so you can plan your finances.

The biggest disadvantage is that working capital loans in the UK can be more expensive than other forms of finance. Secured working capital loans are also restricted by the value of any assets you might have to put up as security. Again, this means that a different approach may be necessary if you want to borrow more money or over the longer term.

How much can you borrow with a working capital loan?

Working capital loans are generally available for amounts upwards of £1,000. The amount you can borrow will depend upon the current circumstances of your business, the reason you want the loan, and the lender you apply to. If your application is successful, these factors will also affect the loan terms you're offered, including interest rates and the repayment period.

What are the alternatives to working capital loans?

There are a number of alternative finance models available for small businesses in the UK, and you may want to consider something else if a working capital loan isn't the right fit for your business.

- Invoice financing is an option for short-term borrowing when cash flow is an issue. This type of financing allows you to borrow against the value of unpaid invoices.

- A business overdraft attached to your business bank account can also help you to manage bumps in the road when cash flow is a problem. One drawback of overdrafts however is that they may have a low credit limit, meaning your business will not have much headroom if you are not bringing in revenue.

Other alternatives to working capital loans include revolving credit facilities, which can be arranged through your bank, and asset refinancing, which lets you borrow against assets that are less easily converted to cash.

How can you get a working capital loan?

As with most business loans, you first need to submit an application to the lender. Many applications are now done online and you'll need to provide some basic details about your business, its operations, and current circumstances. You'll also need to provide some personal information and proof of identity.

Once the application is finished, the lender will use these details along with the information held on your credit file before making a decision to lend. If your application is successful, the terms of borrowing will be dependent upon your credit score and credit history. In general, the better your credit score is, the better the terms of the loan will be.

The only way to make sure you're getting the best rates on a working capital loan is to check with multiple lenders to see what's on offer. But avoid making a number of applications as this can have a negative impact on your credit score.

Alternatively, you can get a helping hand from the tech-enabled team at Bionic. We'll compare what's on offer from a range of lenders to find the right finance option for your business.

What are typical interest rates on working capital loans?

Interest rates differ depending on the type of working capital loan you choose, the lender you go with and if it is secured or unsecured, although secured loans usually have lower interest rates. For example, current rates from our finance division at Think Business Loans could range from 9.9% - 25.4% based on a 72-month period.

An example of a small business needing a working capital loan

If you are a business owner who runs an Indian takeaway and your busiest periods are over autumn and winter with trade slowing up slightly in the summer months then you may run into cash flow issues in the summer. In this case, you might apply for a working capital loan to help you pay your employees and rent over the summer months and then recoup the money back to pay back the loan during busier winter months.

How to get a working capital loan with Bionic

Bionic is here to help every business find the right financial product. We will first establish whether a working capital loan is right for you, and then make the process as easy as possible so you can concentrate on growing your business.

We will tell you what documentation is required from you to get the application process underway as quickly and smoothly as possible. Enter your postcode in the box on the right or at our business loans page to get started.