UK business licences 2026: what do you need for your business?

Setting up a new business is an exciting process. From choosing how and when your business will operate to the products you want to sell or service to offer, going through your company's set up is a big deal.

Before opening your doors, you must make sure that you secure the right business licences to operate legally. What you need to get may be different depending on your industry. We’ve covered it all in this guide.

What is a business licence?

Simply put, a business licence is an official permit that is issued by the government or a professional body that instructs how certain business activities should be run.

Do you need a business licence in the UK?

This depends. The licences your business will need will depend entirely on the type of industry that you operate in, and where you’re based within the country. Not all businesses in the UK require a licence, and in some cases, small businesses can trade without one.

Some individual activities, like street parties or other public events, may also require a one-off licence.

Each licence is designed to keep owners, clients and customers safe, as well as hold businesses accountable for their actions.

Is it different from insurance?

Yes. A licence lets you legally operate, and insurance is a product you buy to help protect your business against risks. It's helpful in case you need to claim, or someone claims against you. If you employ anyone, employers' liability insurance is legally required, other covers are often optional in most cases. Having a licence does not normally include any insurance cover, you need to arrange this seperately and this can be done through a business insurance broker.

First register with HMRC

Before you think about licences, make sure you register your business with HMRC. This applies if you are a limited company or sole trader making over £1,000 per year.

Why do you need a business licence?

Before setting up a business in the UK, you may want to get in contact with your local council. This way, you can easily find out if there are any area-specific requirements, industry-specific permits or zoning restrictions that could limit or halt your business's activities.

The main benefits of getting a business licence are:

- Protection for businesses – Ensuring you have the right licences to run your business can help you avoid fines from your local council.

- Privacy — If you obtain a licence for your business, this should mean that you’re ensuring any personal information will remain private. This also helps to allow your business to be held accountable for its actions.

- Keep track of your finances for tax purposes — This makes it easy to file your taxes once you know which business licence you’ll need.

- Good for the economy — With so many new businesses starting every day, making sure your business is registered and licensed helps to formalise the economy, as it shows the business sector is thriving.

Make sure that you get the right licences before you open, as you’ll be breaking the law if you don’t.

What licences and permits are needed to start a business? (by trade)

This really depends on the type of business you’re opening. If you’re running a hairdressing salon, then you’ll need different licences than if you were opening a cafe.

We’ve broken it down by industry below.

Shops and retail

If you’re planning on opening a retail business or shop, it’s important to get everything in place before you open.

You should consider:

| Retail/shops | Business licence and other considerations: | How to apply / more info | Link to apply |

| PPL PRS Music licence (if playing music) | Apply via PPL PRS | TheMusicLicence | |

| TV licence (if showing TV) | Apply via TV licensing | TV Licence | |

| Pavement/street display licence (for advertising boards) | Apply via local council | Pavement Licence | |

| Data Protection Registration (ICO) | If processing customer data | ICO Registration | |

| Business insurance (if you employ anyone – it's a legal requirement) | Compare quotes with a broker | Shop Insurance |

- Licence to play background music or TV licence — If you’re planning on playing music or showing TV in your shop, you need to have the right licence, by law. You’ll have to apply for the PPL PRS Ltd.'s TheMusicLicence, which could cost from just 78p a day.

- Pavement or street display sign licence — If you’re planning to advertise your business on the pavement or roads, you’ll need to get written permission from the council. This costs around £400 and lasts up to six months.

- Notification to process personal data — If you process customers' personal data, such as their email address or phone number, which can be used to easily identify them, then you need to make sure you’ve got the right GDPR in place.

Salons

Before you let clients through your door, you should consider the following compliance and licences:

Salons (hair/beauty)

| Business licence and other considerations: | How to apply / more info | Link to apply |

| Premises licence (for certain beauty treatments like tattooing, piercing and lasers) | Apply via local council | Special Treatments Licence Example | |

| Personal licence (if serving alcohol) | Apply via local council | Personal Licence | |

| Data Protection Registration (ICO) | If storing client data | ICO Registration | |

| COSHH compliance (if using chemicals for dyeing) | Not a licence, but you should comply with regulations | COSHH Guidance | |

| Business insurance (if you employ anyone – it's a legal requirement) | Compare quotes with a broker | Salon Insurance |

- Premises licence — If you offer specialist treatments like piercings, tattoos, electrolysis or even acupuncture – you should register with your local council.

- Personal licence – If you are a high-end salon and offer your clients prosecco or champagne, you need to have a personal licence in order to serve it.

- Data protection registration – If you store any client data then you should register with the ICO – even if this just phone numbers, addresses and payment history. You may need to pay a fee which is dependent on your business size.

Professional services

Whether you’re an accountant, architect, business consultant or even a photographer, making sure your business is set up correctly is important.

You should consider the following licences:

Professional Services

| Business licence and other considerations:

| How to apply / more info | Link to apply |

| FCA Authorisation (financial services) | Apply to Financial Conduct Authority | FCA Registration | |

| Money laundering registration (for example - accountants, estate agents) | Register with the relevant anti-money laundering supervisor | AML Registration | |

| SIA Public Space Surveillance (CCTV) Licence | Apply to Security Industry Authority | SIA Licence | |

| Pavement/street display licence (for advertising boards) | Apply via local council | Pavement Licence | |

| Data protection registration (ICO) | If processing customer data | ICO Registration | |

| Business insurance (if you employ anyone – it's a legal requirement) | Compare quotes with a broker |

- Money laundering registration — If your business is based in the financial sector, you’ll need to register with an anti-money laundering scheme as well as with a professional body that regulates your industry sector.

- Financial Conduct Authority (FCA) authorisation — If you work in business finance and are planning on offering financial advice or issuing payments or settlements, you’ll need to have authorisation from the Financial Conduct Authority before you can carry out any regulated financial services. If you don’t get proper authorisation before carrying out any activities, you could be fined or imprisoned.

- Public space surveillance (CCTV) licence — You’ll need to get this licence if you plan on using CCTV equipment to record any activities on your business premises. You’ll need to acquire the licence from the Security Industry Authority (SIA), which is £184 for a three-year licence.

Read our guide to professional indemnity insurance that can help protect your business if you need to pay compensation to clients.

Food – Cafes, Takeaways and Restaurants

Whether you're on the high street or tucked away in a hidden nook, there are certain licences you’ll need to obtain to make sure you’re following all guidelines for bars, cafes, takeaways and hospitality businesses. This could include:

| Hospitality (restaurants, cafes, bars and hotels) | Business licence and other considerations:

| How to apply / more info | Link to apply |

| Premises licence (selling alcohol, hot food 11pm-5am, regulated entertainment) | Apply via local council | Premises Licence | |

| Personal licence (for DPS/alcohol sales) | Apply via local council | Personal Licence | |

| Food business registration | Register with local authority at least 28 days before opening | Register a Food Business | |

| Food premises approval (if handling animal-origin products) | Apply via local council | Food Premises Approval | |

| PPL PRS Music licence (if playing music) | Apply via PPL PRS | TheMusicLicence | |

| TV licence (if showing TV) | Apply via TV Licensing | TV Licence | |

| Pavement licence (for outdoor seating) | Apply via local council | Pavement Licence | |

| Machine games duty (if gaming machines on site) | Register with HMRC | Machine Games Duty | |

| Business insurance (if you employ anyone – it's a legal requirement) | Compare quotes with a broker |

- Premises licence and personal alcohol licence — If you’re looking to serve alcohol on your menu, you’ll need to get a premises licence so you’re legally allowed to serve it. You or a member of staff will also need to hold a personal licence to sell alcohol.

- Food premises approval — Before you can begin cooking, you’ll need to make sure you have food premises approval. This will need to be inspected and approved by your local council, and once your status has been approved, you’ll need to display your status according to the council's rules.

- Food business registration — If you plan on storing, cooking, handling, supplying, distributing or selling food on your premises, you’ll need to register this with your local authority. You’ll need to make sure you register at least 28 days before your business opens. If you don’t, you could be fined and face up to 2 years in prison.

- Music and TV licence – if you plan on playing music or have any TVs for sports, for example, then you’ll need to get the applicable licences.

- Permission to place tables and chairs on the pavement — You’ll need to apply for a licence from your local council if you wish to place tables and chairs or other furniture on the pavement outside of your premises. To support your application, you’ll also have to supply a site plan and proof of public liability insurance.

- Machine duty – You might have to pay Machine Games Duty (MGD) if you have machines that give cash prizes (such as slot, fruit or quiz machines) on your premises.

Offices

If you run an office of any size, you should consider the following:

Offices

| Business licence and other considerations: | How to apply / more info | Link to apply |

| Data Protection Registration (ICO) | If processing/storing client or staff data | ICO Registration | |

| Music Licence (if playing music in communal areas) | Apply via PPL PRS | TheMusicLicence | |

| Business insurance (if you employ anyone – it's a legal requirement) | Compare quotes with a broker | Office Insurance |

- Data protection registration – Whatever your business, if you store any client data, then you should register with the ICO. You may be asked to pay a fee which is dependent on your business size.

- Music licence – if you have communal areas, or waiting areas where you play music, then you need a music licence.

Manufacturing

If you have a manufacturing business, then you should consider the following when setting up:

| Manufacturing | Business licence and other considerations: | How to apply / more info | Link to apply |

| Food business registration (if processing food) | Register with council | Register a Food Business | |

| Food premises approval (if handling animal-origin products) | Register with council | Food Premises Approval | |

| MHRA licence (if manufacturing medicines) | Apply to Medicines and Healthcare products Regulatory agency | MHRA Guidance | |

| Industrial denatured alcohol authorisation | Apply to HMRC | HMRC IDA Guidance | |

| Waste carrier registration (if transporting waste) | Apply to environment Agency | Waste Carrier Registration | |

| Environmental permit (for emissions, waste) | Apply to environment agency/local council | Environmental Permit | |

| Business insurance (if you employ anyone – it's a legal requirement) | Compare quotes with a broker | Manufacturing Insurance |

- Food business registration — If you store, supply or distribute food on your premises (including wholesalers), you’ll need to register this with your local authority. This needs to be done at least 28 days before your business opens. If you don’t, you could be fined or worse.

- Food premises approval — If you manufacture food or beverages, you’ll need to have a food premises approval. This will need to be inspected and approved by your local council, and once your status has been approved, you’ll need to display your status according to the council's rules.

- MHRA licence – If you are manufacturing medicines or are a medicine wholesaler, you will need an MHRA licence.

- Industrial denatured alcohol authorisation — If you produce, stock or sell denatured alcohol - you will need a special licence. This does not apply to alcohol you can drink, it’s usually sold for commercial use.

- Waste carrier registration – If you buy, sell, transport or dispose of waste then you’ll need to register as a waste carrier. It’s free if you only transport your own waste – otherwise it’s £154

- Environmental permit – you'll need to apply for a permit if any manufacturing activities pollute the air, water or land, increase flood risk or badly affect land drainage.

Online retailers

In many cases, you can trade without a business licence in the UK if you’re an online or small business, as long as you’re properly registered with HMRC, no more than three months after you start trading. However, you should consider:

| Online Business | Business licence and other considerations: | How to apply / more info | Link to apply |

| Data protection registration (ICO) | If processing customer data | ICO Registration | |

| Compliance with distance selling and consumer protection regulations | Not a licence, but legal requirement | Online Selling Regulations | |

| Business insurance (if you employ anyone – it's a legal requirement) | Compare quotes with a broker | E-commerce Business Insurance |

If you’re selling goods online within the UK, you will have to follow certain rules. You must make sure that your business follows the rules of ‘before an order is placed’. These include:

- Making it clear to customers that they have to pay when they place an order — Through a ‘Pay Now’ button.

- Clearly display the methods that customers can pay — For example - Apple Pay or PayPal, for instance. This must also include delivery costs and options.

- Give customers time to amend any orders — For example, ASOS have a ten-minute grace period in which you can cancel your order. Amazon allows 30 minutes to cancel orders if they’re sold through a third- party seller.

- Language options — Let customers know what languages are available on site.

- Make customers aware of your terms and conditions — Make sure these can be downloaded and printed off.

- Description of goods — Go into as much depth as possible when describing your items. Product listing, whether it be for goods, services - digital content needs to be detailed.

Commercial and residential property

| Commercial and residential property | Business licence and other considerations: | How to apply / more info | Link to apply |

| Planning permission (for change of use or building works) | Apply via local council | Planning permission | |

| HMO licence (if letting as house in multiple occupation) | Apply via local council | HMO Licence | |

| Asbestos management (if relevant) | Not a licence, but legal duty for older buildings | HSE Asbestos Guidance | |

| Environmental permit (for emissions, waste) | Apply to Environment Agency/local authority | Environmental Permit | |

| Business insurance (if you are a property owner) | Not a legal requirement but a consideration. Compare quotes with a broker |

- Planning permission — You may need to let the council know if you are changing the use of your building – it was a house and is now being used as a shop, for example. Or if you are planning an extension.

- HMO licence — If you are renting a property out to more than 3 people that make up more than one household - like a house share then you need a HMO licence.

- Asbestos Management — This is not a licence, but as a commercial landlord, it’s your legal duty to manage asbestos in old buildings. You should assess the risk and make a plan to manage it.

Service-based business/sole trader

Any service-based business in the UK will have to register for any licences accordingly. A service-based business can be anything from a gardener to a taxi driver, a tutor, or a window cleaner, so it’s important to make sure that you have everything in place to successfully (and legally) run your business.

| Service Businesses | Business licence and other considerations: | How to apply / more info | Link to apply |

| Permission to distribute leaflets | Apply via local council | Leaflet Distribution | |

| UK Driving licence (for driving-based services) | Must hold a full UK driving licence | Driving Licence | |

| Taxi/private hire licence | Apply via local council | Taxi Licence | |

| Environmental permit (waste disposal, emissions, etc.) | Apply via Environment Agency/local council | Environmental Permit | |

| Business insurance (if you employ anyone then it’s a legal requirement) | Compare quotes with a broker | Business Insurance |

Before you start your business, here are a few of the licences you’d need to acquire:

- Permission to distribute leaflets — If you want to advertise your business through leaflets or flyers, you’ll need to obtain this licence to get consent to distribute free printed materials in areas that are controlled by the local council.

- UK driving licence — You’ll need to hold a full UK driving licence as well as a taxi driver licence if you want to drive a black cab.

- Environmental permits — To dispose of waste safely, you may need to apply for an environmental permit from your local authority.

What about side hustles and hobbies?

You shouldn’t need a licence if you are making money from any side hustles (even if they are hobbies). But the amount of profit you make exceeds the £1,000 limit, then you will need to register with HMRC and fill in a self-assessment.

What is a trade licence?

Providing the best service is at the top of your priority list if you work in a trade-based business. Whether you’re a painter and decorator, carpenter, plumber or electrician, your reputation as a tradesman is dependent on working with the correct trading licences.

Before you carry out any activities, here are some of the business licences you’d need to consider:

- Skip licence — This licence allows you to place a designated skip on a footpath or public road. If your client has space to put the skip on their private property, you won’t need to obtain a licence. The cost of a skip licence varies depending on where you are in the UK, but can cost from around £30 in London.

- Goods vehicle operator licence — If your business uses goods vehicles above a certain weight, you’ll need to obtain this licence. There are three different types of licences - standard national, standard internal and restricted. The one you need will depend on where you transport goods to and from, and who you do it for.

- Scaffolding and hoarding licence — Whether you’re carrying out maintenance, building work or removal, this licence is required. You’ll need to make sure that the application is submitted at least 15 days before work is due to be carried out. A licence for both scaffolding and hoarding is £151 each which you can get from the government website.

- Register to carry out gas work — To legally carry out any gas work, you must make sure that your business is on the Gas Safe Register. Find out what the Gas Safe Register is and why it’s so important with our guide.

- Street works licence — If you plan on placing heavy or street work machinery on a public road in England, Scotland or Wales, you’ll need to obtain this licence from your local council. If you fail to obtain the right documentation or have it in place when carrying out any work, this could result in a fine of up to £5,000

Selling restricted goods

If you’re planning on selling restricted goods, like alcohol for an off-licence or newsagents or nail varnish, then you’ll need to apply for multiple licences to do so.

- Personal licence — This requires you to take the BIIAB Level 2 Award for Personal Licence Holders from an accredited provider. You’ll then have to apply for a personal licence on the government website.

- Premises licence — This licence can be fixed on any commercial property, like a shop floor or warehouse, but isn’t usually granted for your home as this is classed as a domestic dwelling. However, a small building that’s on your land, but is separate from your house, could be given a licence. You’ll need to apply for a premises licence through your local authority.

How to get a business licence in UK

The first step to applying for a business licence is figuring out which licences you need. Use our tables above, or if you’re business that is not listed go to the government site to find out.

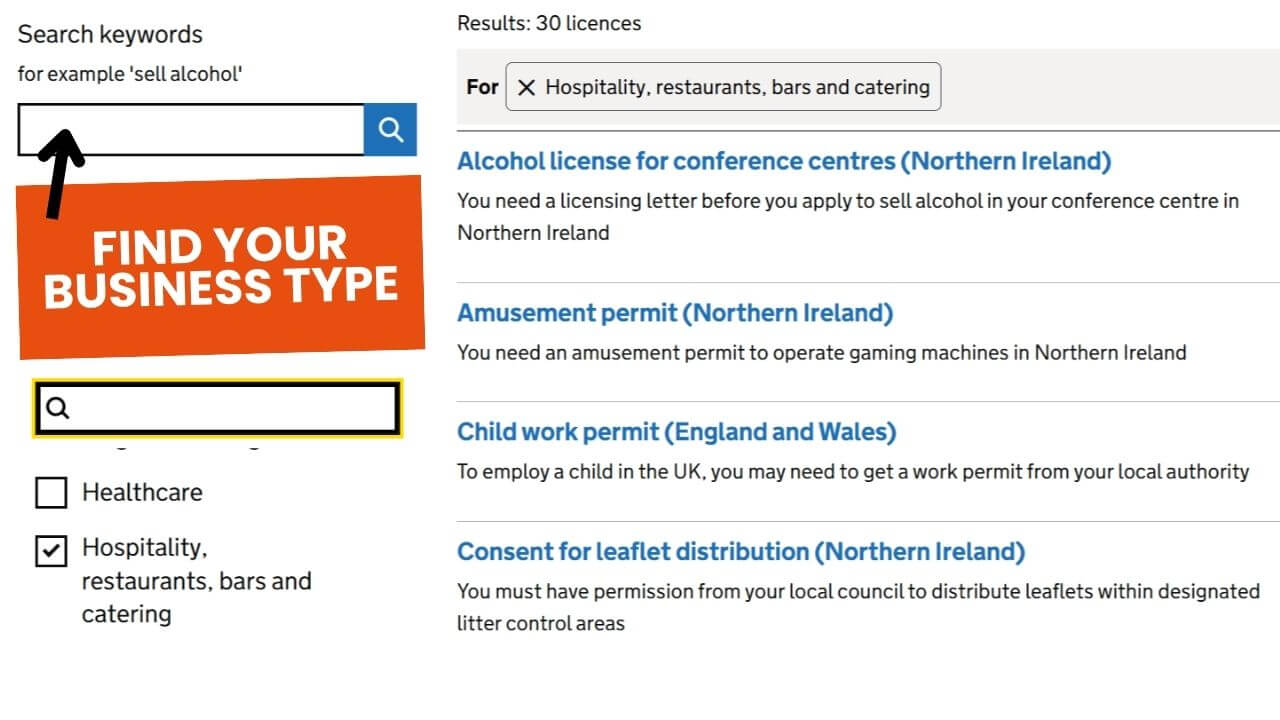

How to use the government licence finder tool

The government site has a licence tool finder to help with filtering down what you need. Just type your business category into the search bar or select from the dropdown.

Contact your local authority for local requirements

Many business licences are granted by individual local authorities, typically in the area where you’ll be running your business. You can pick up licence application forms from your local office or download the licence forms from the government website.

Regional differences

There are some regional differences when it comes to licences. If you want to run a childminding business, for example, you’ll need to apply for a licence from a specific governing body:

- Ofsted in England – register on the government site

- Care Inspectorate in Scotland – register here

- Care and Social Services Inspectorate in Wales – register here

- Department of Health, Social Services and Public Safety in Northern Island – register here.

Your local council can notify you of any regional variations.

How much does a business licence cost?

As with many business licences, it’s hard to give a solid figure for each of them. The cost of a licence will depend on what type it is, where your business is based and even why you are applying. Local authorities tend to set the prices.

What happens if I breach the conditions of a business licence?

If you do breach any conditions of a business licence, whether it be accidental or otherwise, you could run into some trouble.

Alex McCloy, Legal Counsel at Bionic, states - “It's not a good idea to run your business without the right business licences in place. They are there to provide regulation, protect customers and keep business owners accountable. If you don’t have them when the council come knocking one day, playing ignorant isn't going to go down well and you could end up with a hefty fine.”

How bad are the consequences?

- You may be fined

- Your licence may be revoked

- You may not be able to reapply for the licence again

- Your business may have to close

- In the worst case, you could even go to prison

Read our guide on legal expense insurance to make sure you’ve got the proper cover in place should the worst happen to your business.

A cafe owner was sent a demand for £810

A small cafe owner on Reddit received a letter from the council demanding a £810.10 payment for a music licence and threatened legal action. The owner states he plays free music which doesn’t need a licence. The discussion from other business owners suggests the council go after small businesses that they suspect are playing music without a licence.

This stresses just how important it is to have the right licences in place, in case you ever get caught out. Even if you're playing commercial radio for your customers – you need a music licence.

Can you get insurance without a business licence?

Yes - you don’t legally need to obtain a business licence before insuring your business. But if you start trading without the required licences, you might run into other issues.

For example, if you are a food based business then you need to register for the correct licences with the FSA. Whilst new businesses won't always have these, your insurance policy may be subject to you achieving a certain score following an inspection.

Your guide to business licences

Whatever your business, it’s important that you have the proper business licences in place. While this can sometimes feel overwhelming to know the exact licences you’ll need to acquire, it’s important you get the right ones before you start trading, to save yourself from some hefty legal fees.

Get in touch with us to discuss your needs or get more information on business insurance today.