* By submitting your details you agree to our terms and conditions and privacy policy . We promise we won’t share your data with others for marketing purposes.

Compare professional indemnity quotes

Protect against legal claims from clients or third parties

Get cover for professional errors, advice, disputes and negligence

Bionic is the comparison site for your small business

We compare a vetted panel of trusted business suppliers

Bionic arranges business insurance for limited companies, sole traders and partnerships

Get tailored cover to protect your wallet against unexpected legal costs or compensation

Only pay for the protection you need — no unnecessary extras

What is...

professional indemnity insurance?

Professional indemnity insurance - or PI insurance - is a type of business insurance that helps protect you if you need to pay compensation to your clients as a result of a professional mistake or negligent advice. It is typically taken out by businesses that provide professional services like accountants, contractors or consultants.

Businesses like these, such as law firms, may be sued by clients who lose money because of what they think was bad advice or poor service. In these instances, PI insurance can cover your costs and could save you from financial difficulties.

Professional Indemnity insurance can provide a financial safety net in the event of a claim and gives you peace of mind, so you focus on what’s most important - helping clients.

Who needs professional indemnity insurance?

If work in the following professions you should consider PI insurance:

- Accountants

- Consultants

- Contractors

- Engineers

- Creatives (for example, agencies or designers)

In some cases, PI may be required by your regulator – for example, architects and solicitors.

What does product liability insurance cover?

Coverage varies per provider and package. Always check your policy details to see what is covered in your policy. PI can help cover the following:

Professional mistakes

Protects against claims for professional negligence, incorrect advice, and contract disputes

Legal costs & compensation

Defending your business in court can be costly, PI can help with paying a solicitor and compensation you need to pay.

Loss of documents

If you’ve lost important client documents like contracts, then this can help costs if the client decides to sue you.

Why do you need professional indemnity insurance?

It can help cover the following costs:

Legal costs & compensation - Defending your business in court can be costly, PI can help with paying a solicitor and any compensation you need to pay out.

Loss of documents - If you’ve lost important client documents like contracts, then this can help costs if the client decides to sue you.

Coverage varies per provider and package. Always check your policy details to see what is covered in your policy.

Professional indemnity insurance is not just a policy — it’s peace of mind. It may help cover legal costs and potential compensation if a client alleges financial loss due to your professional advice or services.

James Barwell - Insurance Director

How much is professional indemnity insurance?

How much you pay for PI cover will vary depending on several factors unique to your business, including:

- Business Industry – Some industries are riskier than others which may cost you more, like financial services.

- Business size – Larger businesses with more turnover may need more cover.

- Claims history – If you have previous claims, this can affect your quote price.

- Policy coverage level - The higher the level of cover, the more expensive your premium is likely to be.

To find out exactly what it’ll cost to insure your business, speak to a member of our insurance team today.

Find out why your business needs insurance from Les, our Business Comparison Expert.

How Bionic business insurance comparison works

Compare insurance quotes in three simple steps

1

Start your quote online

Speed up the process by submitting basic business details online – whenever you have time.

2

Speak to our UK-based team

Schedule a call with one of our insurance brokers to discuss the details to ensure they’re correct.

3

Compare tailored quotes

Get your quotes from our panel of trusted insurers and through any questions with our team.

What do I need to get started?

You only need a few details to get started with getting a business insurance quote online, so it’s best to have the following information ready to go:

Your business name and trade

Your policy start date

Your name and contact details to receive your quote options

You may be asked additional questions about business activities

Professional Indemnity FAQs

Our team shares essential knowledge on business insurance

What insurance do I need for my small business? 2025 Guidance

Finding the right business insurance shouldn't feel like navigating a maze blindfolded. Yet many small business owners are confused about what they actually need versus what is on offer. We cut through the generic advice to give you answers in our guide.

Why do business insurance premiums increase after making a claim?

Sometimes you have to make a claim on your business insurance, but what happens afterwards? Learn more about the claims process and why premiums can go up in our guide.

Do you need insurance for your side hustle?

We all love to make an extra bit of on the side, but what happens your side hustle goes sideways? If you don't have any business insurance in place, you could end up paying out the cash you've earnt in legal fees or otherwise. Find out what you need to protect your side hustle in this guide.

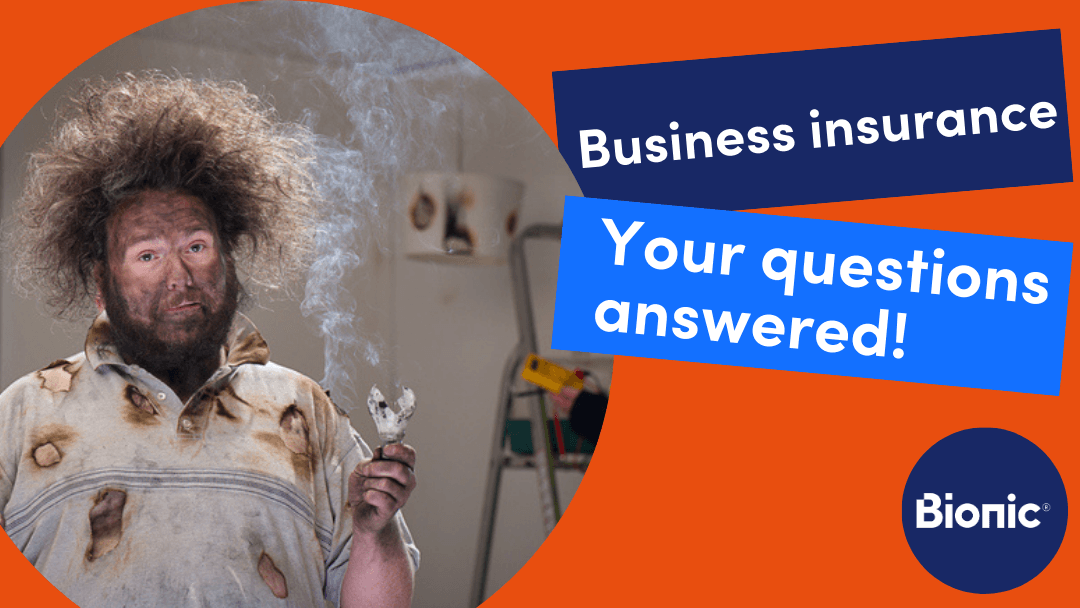

Business Insurance FAQs: Your most asked questions, answered by our insurance team

Charlie & Les talk through everything you need to know about business insurance cover so you can make an informed decision for your business.

Not your usual boring business content!

Sign-up to The Backbone, our free fortnightly newsletter for anyone who owns, runs, or works in one of the millions of businesses across the UK. Get the inside track from real business owners just like you