The best places to start a business in the UK

With 2.74 million registered businesses in the UK* across many different sectors from salons to takeaways, there is a large appetite for businesses of every sort in the UK.

However, starting a business comes with its challenges. Rising crime rates and an increase in extreme weather events across the UK mean that prospective business owners might need a little guidance to help them choose the right location to start a business and find business insurance to help protect it.

So, where is best to start a business in the UK?

UK business statistics and key findings

- Hackney is the best place in the UK to set up a business

- Outside of London, Mansfield is the best place to start a business in the UK

- North Lincolnshire's economy is the fastest growing in the UK growing by 49% since 2020

- 2,151 burglary and theft-related crimes were reported against Birmingham businesses last year - the highest in the UK

- Businesses in Argyll and Bute face the highest flood risk in the UK, with an average daily rainfall of 6.2mm

The best places to start a business in the UK

| Rank | Local Authority | Number of Businesses % Difference 2020-24 | Number of Businesses in 2024 in each LA | Businesses Per 1,000 Pop | Number of Industries in each LA | GDP 2022 | Regional gross domestic product (GDP) % Growth 2020-2022 | Precipitation Summer 2001-2020 median (Daily) mm | Precipitation Winter 2001-2020 median (Daily) mm | Crimes Recorded (Non-residential burglary/Theft - burglary business & community) | Affordability Ratio | Index Score /100 |

| 1 | Hackney | 15.2% | 24.8% | 25725 | 91 | 17 | £47,985.00 | 1.6 | 1.7 | 734 | 13.0 | 43.9 |

| 2 | Mansfield | 13.7% | 12.0% | 3240 | 30 | 18 | £20,187.00 | 1.7 | 2.0 | 87 | 5.7 | 42.0 |

| 3 | Ipswich | 12.9% | 9.4% | 4675 | 33 | 18 | £36,583.00 | 1.6 | 1.6 | 129 | 7.3 | 40.7 |

| 4 | Blackburn with Darwen | 12.6% | 23.1% | 5500 | 37 | 18 | £28,019.00 | 2.9 | 4.1 | 241 | 4.3 | 40.5 |

| 5 | Kingston upon Hull, City of | 4.7% | 27.3% | 6500 | 25 | 18 | £29,240.00 | 1.7 | 1.7 | 366 | 4.2 | 40.0 |

| 6 | Torfaen | 15.5% | 19.2% | 2500 | 27 | 18 | £24,061.00 | 2.3 | 4.9 | 116 | 5.2 | 40.0 |

| 7 | Camden | 10.0% | 23.7% | 36290 | 134 | 18 | £174,117.00 | 1.7 | 1.8 | 1,045 | 17.0 | 39.6 |

| 8 | Doncaster | 5.2% | 16.7% | 9840 | 32 | 18 | £24,968.00 | 1.6 | 1.5 | 694 | 5.0 | 39.0 |

| 9 | Thanet | 11.9% | 17.5% | 4530 | 32 | 18 | £20,793.00 | 1.4 | 1.5 | 147 | 10.6 | 38.8 |

| 10 | Wolverhampton | 10.0% | 21.6% | 8200 | 31 | 18 | £25,595.00 | 1.9 | 2.0 | 516 | 6.3 | 38.4 |

Hackney is the best place in the UK to start a business

With a 15.2% rise in local businesses over the last five years and a 24.8% increase in GDP since 2020, Hackney ranks as the UK's best place to start a business.

Over the past 15 years, the borough has experienced lots of social and economic growth and has driven initiatives like the Inclusive Economy Strategy to create a more inclusive community.

Investment projects, including those delivered by Hackney Impact, have been key in supporting small businesses and social enterprises - in recent years, up to 250 businesses and social enterprises have benefited each year from the business support programme, following the Council’s approval of a £700,000 support package for Hackney’s business community. Given this progress, Hackney’s top ranking comes as no surprise.

Mansfield is the best place to start a business outside of London

Outside of London, Mansfield is the top location to start a business. Since 2020, the number of businesses has risen by 13.7%, GDP has grown by 12.0%, and industry diversification has flourished, making Mansfield a thriving hub for enterprise.

We spoke to Mansfield District Council’s Portfolio Holder for Regeneration and Growth, Cllr Stuart Richardson, who said: “Mansfield is most definitely open for business and the place to be if you want to reach customers.

Mansfield’s fortunes appear to be on the rise and this district is not only a great place to live and work but also a sound place to invest. With various multi-million pound investments on the horizon for the town centre, Mansfield is going to blossom in the coming months and years.”

The fastest and slowest growing economies in the UK

North Lincolnshire’s economy is the fastest growing in the UK

With 49.6% GDP growth since 2020, North Lincolnshire boasts the UK’s fastest-growing economy.

In recent times, North Lincolnshire Council has been driving change through initiatives like the Economic Growth Plan 2023-2028, which aims to capitalise on the current strength of the economy in North Lincolnshire to create high-skilled jobs and attract investment.

Since 2018, North Lincolnshire Council has also administered over £61 million in grant programmes to support businesses and invested £5.47 million from the UK Shared Prosperity Fund into communities, local businesses, people and skills across the area.

South Derbyshire’s economic growth is the slowest in the UK declining by 10.9% since 2020

South Derbyshire's economy has struggled to recover since the COVID-19 pandemic, with GDP growth declining by 10.9% since 2020—the slowest in the UK.

While COVID-19 impacted the entire country, South Derbyshire and the wider East Midlands were hit harder than most, with the region experiencing a 15% drop in output in 2020, according to the Office for Budget Responsibility.

South Derbyshire Council’s Economic Development and Growth Strategy (2023-27) states key local industries, such as food and beverage services and wholesale and retail, saw steep declines of 85% and 63% in output respectively and 32.0% of businesses reported major losses in turnover due to Covid-19 restrictions - 36% experienced a drop of up to 50%.

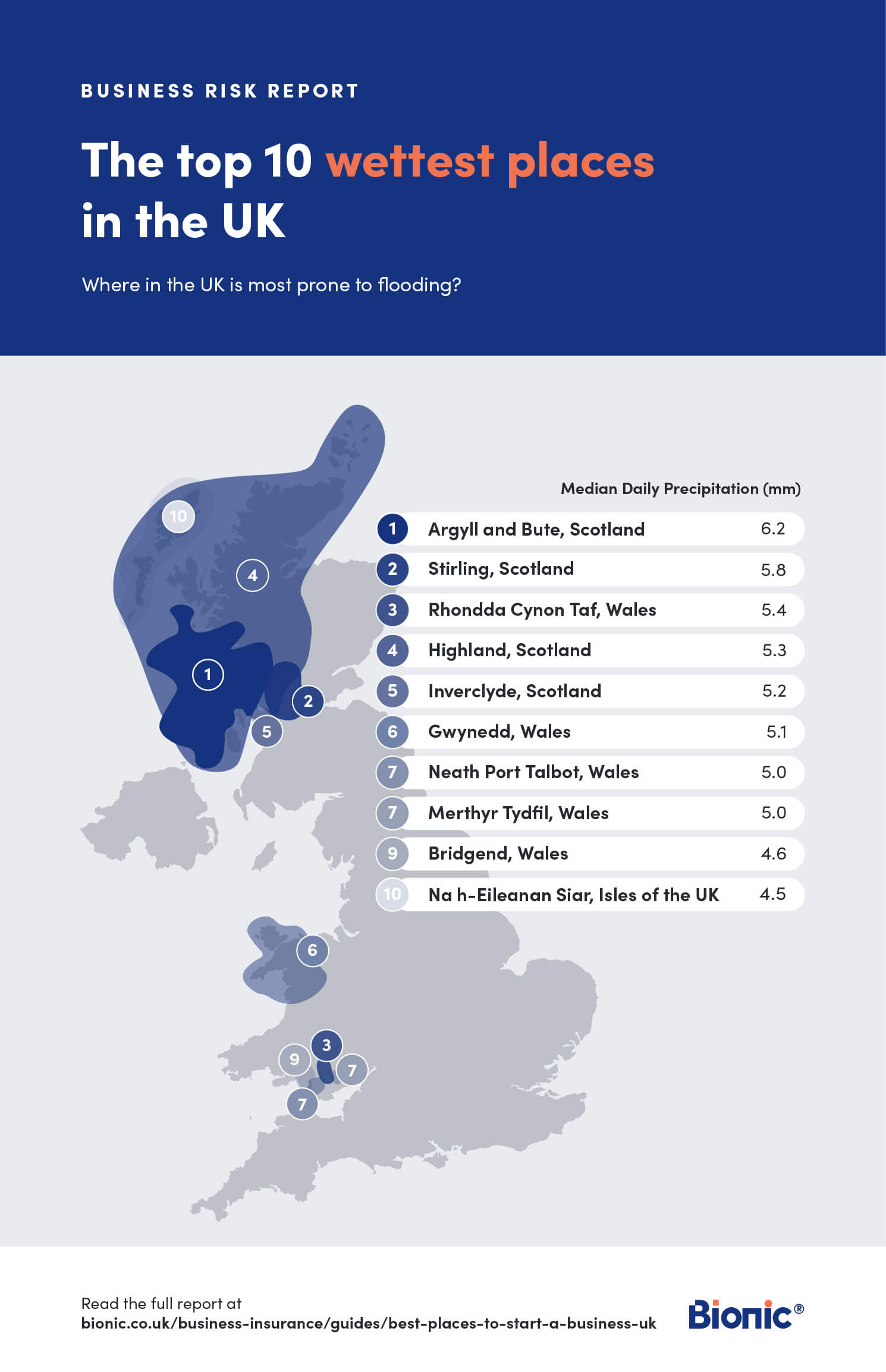

The wettest places in the UK

The impact of weather on UK businesses

With over 27,000 Google searches for “weather insurance” and an average of 36,630 searches for “flood defences” per month in the UK, business owners are increasingly looking for ways to protect their businesses against storms, floods, and extreme weather.

The UK has experienced a sharp rise in severe weather events, with more frequent storms, major flooding, and extreme weather warnings. In 2024 alone, the country faced nine storms, and in just the first four months of the year, 4,858 flood alerts and warnings across Great Britain. Adding to the extreme conditions, January 2025 saw the coldest nights in 15 years.

Extreme weather can be a major threat to businesses, with storm damage and flooding causing significant financial strain. With 40% of small businesses never reopening after a flood, it’s crucial for businesses to have effective protection and defences in place, including a comprehensive flood plan, to mitigate both short- and long-term impacts of extreme weather.

Argyll and Bute is the wettest place in the UK

Argyll and Bute is officially the wettest place in the UK, with an average daily rainfall of 6.2mm. Its location on the western Scottish coast, combined with exposure to the Atlantic Ocean and mountainous terrain, makes heavy rainfall—especially in winter—a regular occurrence.

In November 2024, the region faced 65mph winds and a yellow weather warning due to Storm Bert and in October 2023, severe rainfall caused £15.0 million in infrastructure damage across parts of the area.

Welsh businesses are extremely prone to flooding

With five Welsh local authorities among the UK’s 10 wettest places, Welsh businesses—especially in the south—face extreme flood risks.

The Welsh Government’s National Strategy for Flood and Coastal Erosion Risk Management (FCERM) highlights that over 245,000 properties are at risk from rivers, the sea, and surface water with climate change expected to heighten these figures due to heavier rainfall, severe floods, and rising sea levels.

In Rhondda Cynon Taf (RCT), flooding remains a major threat, with the area receiving 5.4mm of rain daily (1,971mm annually)—the highest in Wales. During Storm Bert (Nov 2024), RCT saw over a month’s worth of rain in a short period, affecting 200 properties.

At present, RCT County Borough Council has put together the Flood Risk Management Plan which details a plan for managing local flood risk over the next 6 years in an attempt to safeguard Rhondda Cynon Taf against extreme future flooding.

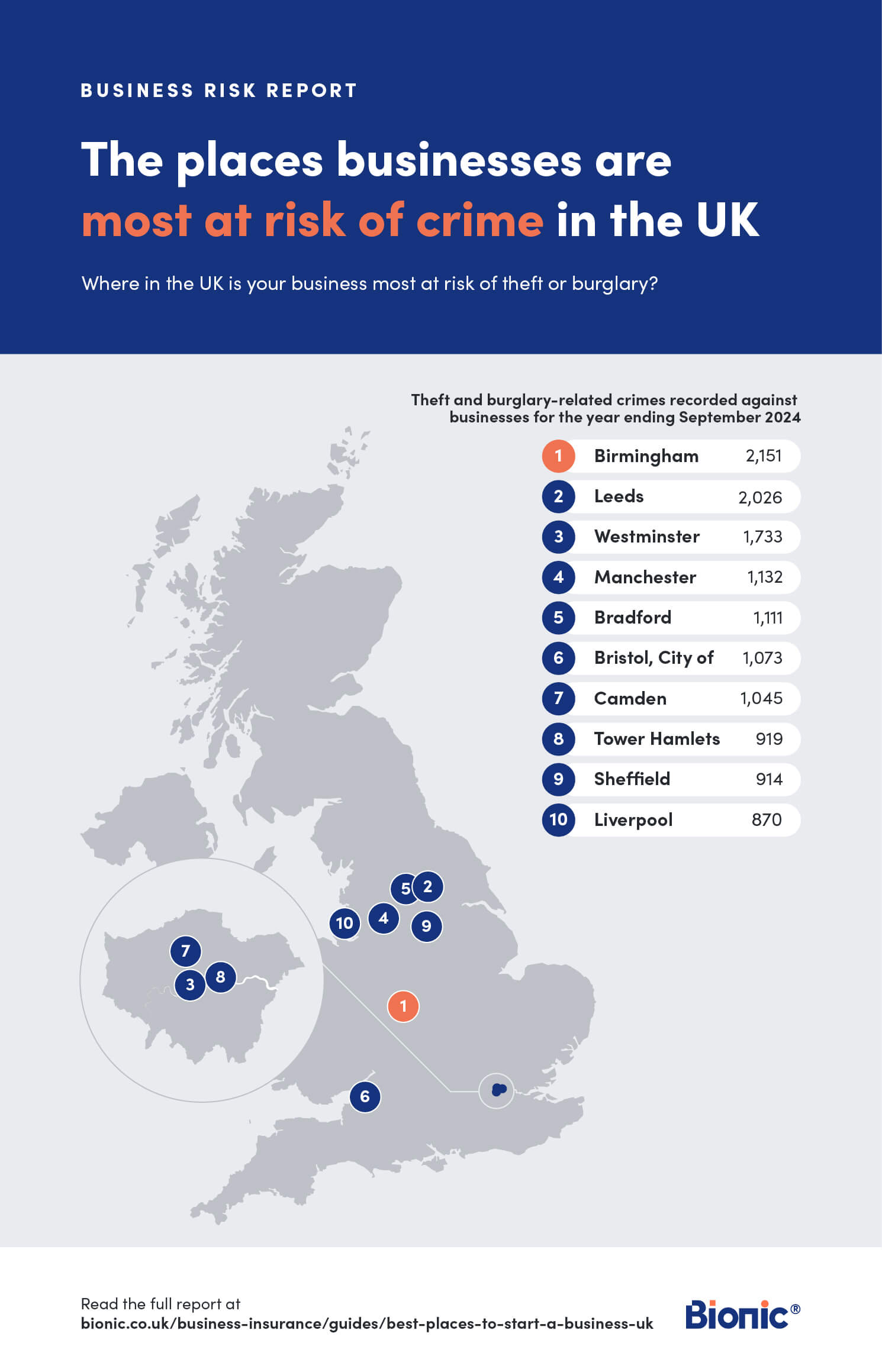

The places businesses are most at risk of crime in the UK

Birmingham businesses are most at risk of burglary and theft after 2151 crimes were recorded last year

In the year ending September 2024, 2,151 theft and burglary-related crimes were recorded against Birmingham businesses - nearly 6 a day—the highest in the UK.

As of 2025, Birmingham’s crime rate is 35.0% higher than the West Midlands average and 57.0% higher than the overall rate for England, Wales, and Northern Ireland. In addition, from January to December 2024, 8.0% of crimes in Birmingham were related to shoplifting, while 5.0% were burglaries.

Over the past 12 months, according to West Midlands Police, 38.0% of crimes in Birmingham City Centre resulted in an ‘unable to prosecute’ outcome, while 31.5% of cases were closed with no suspect identified. These figures help explain why business-related crime in Birmingham remains significantly higher than elsewhere in the UK.

How to protect businesses from theft or burglary?

With there being 80,949 burglary and theft crimes recorded against businesses in the year ending September 2024, equating to nearly 222 a day, crime is rife countrywide, especially against businesses.

For business owners looking to safeguard their businesses from theft or burglary, taking proactive preventative and precautionary measures is essential. Implementing security strategies such as installing CCTV and using crime mapping to analyse local crime trends can significantly reduce risks.

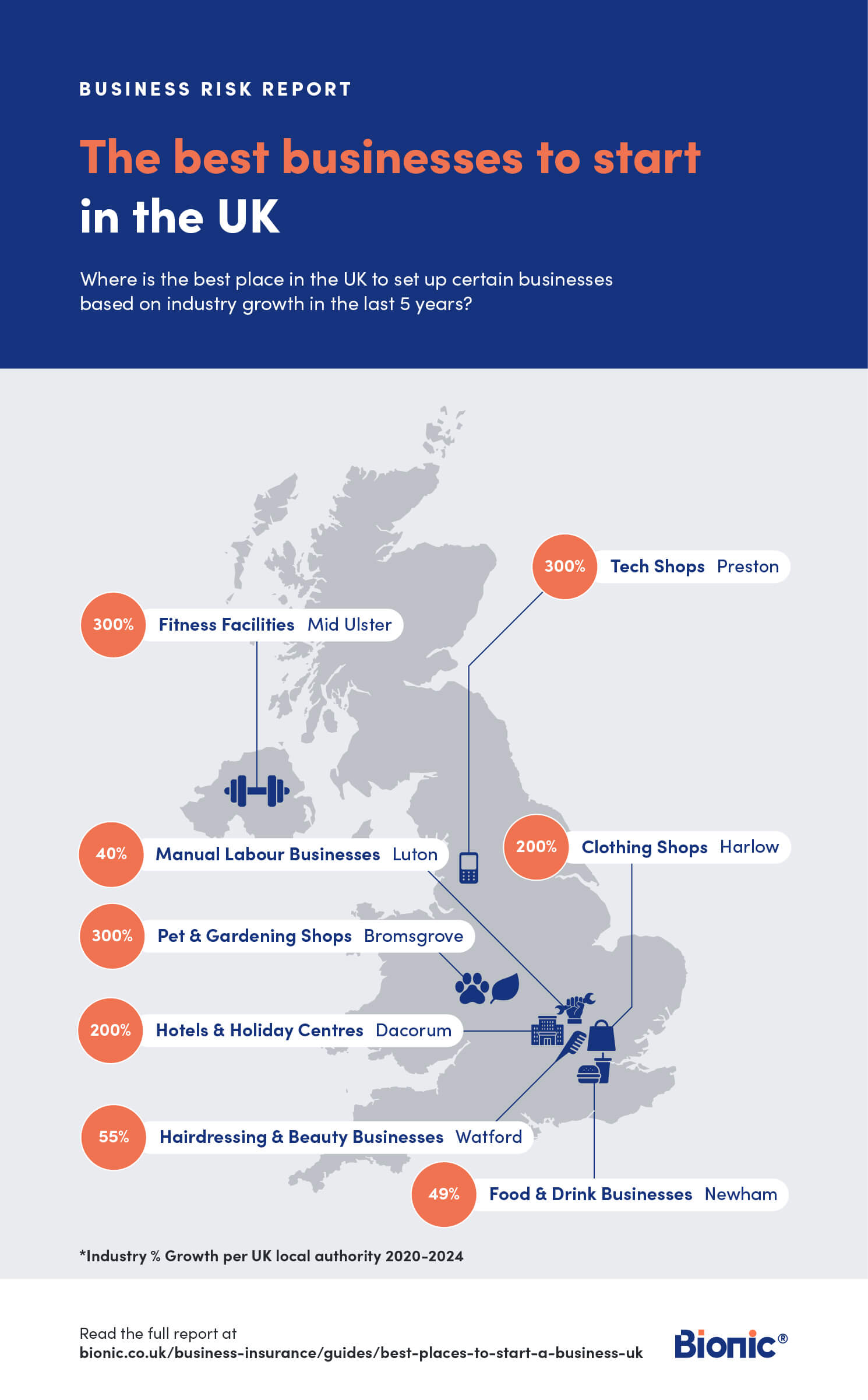

The best businesses to start in the UK

At Bionic, we’ve analysed key industries and identified which businesses are best to start, along with the best locations in the UK to start them, based on industry growth across all UK local authorities over the past five years.

Mid-Ulster is the fitness capital of the UK

Fitness and working out have recently surged in popularity, with a remarkable 28.5 million posts tagged with #gymtok and 4.9 million tagged with #fittok on the popular social media platform, TikTok. Additionally, there are an average of 673,000 monthly Google searches for “gym near me,” indicating that more people are prioritising their health, signing up to gyms and striving to get fit now more than ever before.

This trend is fantastic news for the fitness industry, especially in Mid-Ulster, where the number of new fitness facilities opening has rocketed by 300% over the past five years.

The hairdressing and beauty industry is booming in Watford

The hairdressing and beauty industry in Watford is experiencing significant growth, with a 55.0% rise in new salon businesses opening in the area over the last five years.

With the hairdressing and beauty industry flourishing in Watford, we spoke with Laura Derrouiche, the owner of the award-winning LALA Salon, who was named Watford’s ‘Favourite Hair Salon 2024’ in the Watford Observer’s annual ‘Your Favourite’ competition.

She shared: “Watford offers a great community and a supportive environment. I believe that when you combine a strong local community with an unwavering dedication to your clients, you create the perfect foundation for success. It’s this balance that has allowed our salon to thrive and it’s philosophy I see reflected in many of Watford’s best businesses.”

Luton named as the best place for tradies with a 39.8% surge in new business since 2020

Over the last 5 years, the number of manual labour businesses opening in Luton has soared by 40.0%, making Luton the best place in the UK for current and prospective tradespeople.

With the average salary for Luton-based tradesmen being 21.0% above the UK industry average, it’s no wonder that there has been a notable increase in the opening of new manual labour businesses in the area since 2020.

How to start a business in the UK

When starting a business, it's vital to choose the right location and industry, but it's equally important to have all the essentials in place to ensure smooth operations.

The importance of business insurance

When starting a business, securing the right business insurance is essential to help protect against unexpected financial losses or claims. It doesn’t have to be expensive, but having adequate coverage helps ensure your business is prepared for unforeseen events.

At Bionic, we sourced 36,571 business insurance quotes in 2024. We then analysed premiums sold by Bionic to uncover the cheapest premium sold by insurance package in 2024.**

| Insurance Package | Cheapest Insurance Premium Sold |

| Trades & Professions | £31 |

| Directors and Officers | £33 |

| Offices & Surgeries | £41 |

| Working From Home | £56 |

| Professional Indemnity Combined | £102 |

| Property Owners | £115 |

| Commercial Combined Package | £176 |

| Shops & Salons | £224 |

| Charities and Sports Clubs | £290 |

| Pubs & Restaurants | £309 |

Looking at our 2024 data, the Trades & Professions Insurance Package had the cheapest premium sold at £31. These are suitable for tradesmen like plumbers, bricklayers. Directors and Officers had the cheapest premium sold at £33 while shops and salons had the cheapest premium sold at £224.

We sold a total of 4,211 shops and salon packages in 2024 – accounting for 31.40% of all insurance quotes obtained by Bionic last year, making it one of the most in-demand packages.

This difference in price between the cheapest packages to insure and the most expensive is down to the different nature of the businesses and the risks involved. For example, a shop or salon is likely to have a physical premises and therefore might take out building insurance as part of their package. A pub or restaurant may be considered a higher risk due to working with hobs and fat fryers.

While tradesmen might not need building insurance if they don’t have a physical premises, instead they might want to consider tool insurance to help protect their essential equipment.

It’s important to note that your actual premium may vary from the figures above based on the unique needs of your business. Always speak to your insurance broker regarding the level of cover your business requires to ensure you have the correct level of cover in place.

Overall, insurance can help cover potential issues such as slips, trips, and property damage, making it a valuable investment. When the unexpected happens, the cost of insurance is often well worth the peace of mind and financial protection it can provide.

Get your business started with Bionic

At Bionic, we have all the key services to help with starting a business from energy, and insurance to broadband advice. Learn more with our business guides, or get in touch today by starting a quote online.

Methodology

Using ONS data and Nomis* data we identified the number of businesses opening and closing from 2020 to 2024 and identified which local authority had the highest increase in each industry. We also looked at weather, crime, population and GDP data to create a rank for the least risky areas for businesses.

We also combined some areas to make sectors specific for Bionic to see which city had the highest percentage increase in these business types.

**We totalled the sum of quotes obtained by Bionic from Acturis (our insurance CRM system) in 2024, resulting in 36,571. From the quotes obtained, we filtered by insurance package to identify which package had the most quotes obtained. This was Shops and Salons with 11,477 which resulted in 31.4% of quotes obtained.

We then looked at insurance packages sold by Bionic in 2024. From our 112,118 packages sold, we took the minimum invoice amount

for each package sold and ordered them from lowest to highest. We excluded any packages with less than 10 counts sold to avoid skewing data. From our analysis, we were able to identify the top 10 cheapest premiums sold for different insurance packages in 2024.

The cheapest premiums sold by Bionic for the individual insurance packages are not reflective of the insurance premiums the average Bionic customer can achieve. These figures are intended to highlight the cheapest premium sold by Bionic in 2024, most insurance premiums for these individual insurance packages will be higher than those stated. This is because insurance premiums are affected by factors such as business risk, location, claims history and the level of cover required. Therefore, all these circumstances will affect an individual's premium and potentially increase it. They may also not be reflective of industry-wide statistics as Bionic only services UK SMEs. The cheapest policy may not always be the best policy for your business, but having the right coverage can help protect you against the risks associated with running a business.

Our experience has shown that typically, customers who carry out either high-risk activities (work at height/depth or involving heat) or have significant sums insured within their business generate an increased premium from underwriters. This can be minimised by demonstrating positive risk management that we encourage in all our clients.