UK Business Finance: VAT, Loans & Funding For Your Tax Bills

Most businesses will need finance at some point, whether it’s to fund expensive purchases and large stock orders or to plug short-term gaps in their cashflow.

You can also use business finance to pay your tax or VAT bills. Tax for businesses can be a major expense, but borrowing money so you can spread the cost could help.

This guide will help you to understand your options when it comes to finding finance for tax and VAT bills.

What bills do businesses have to pay?

Running a small business comes with its fair share of costs. To avoid falling into debt, you should keep on top of what bills your business has to pay, when to pay them, and how. These are just some of the common bills you need to be aware of:

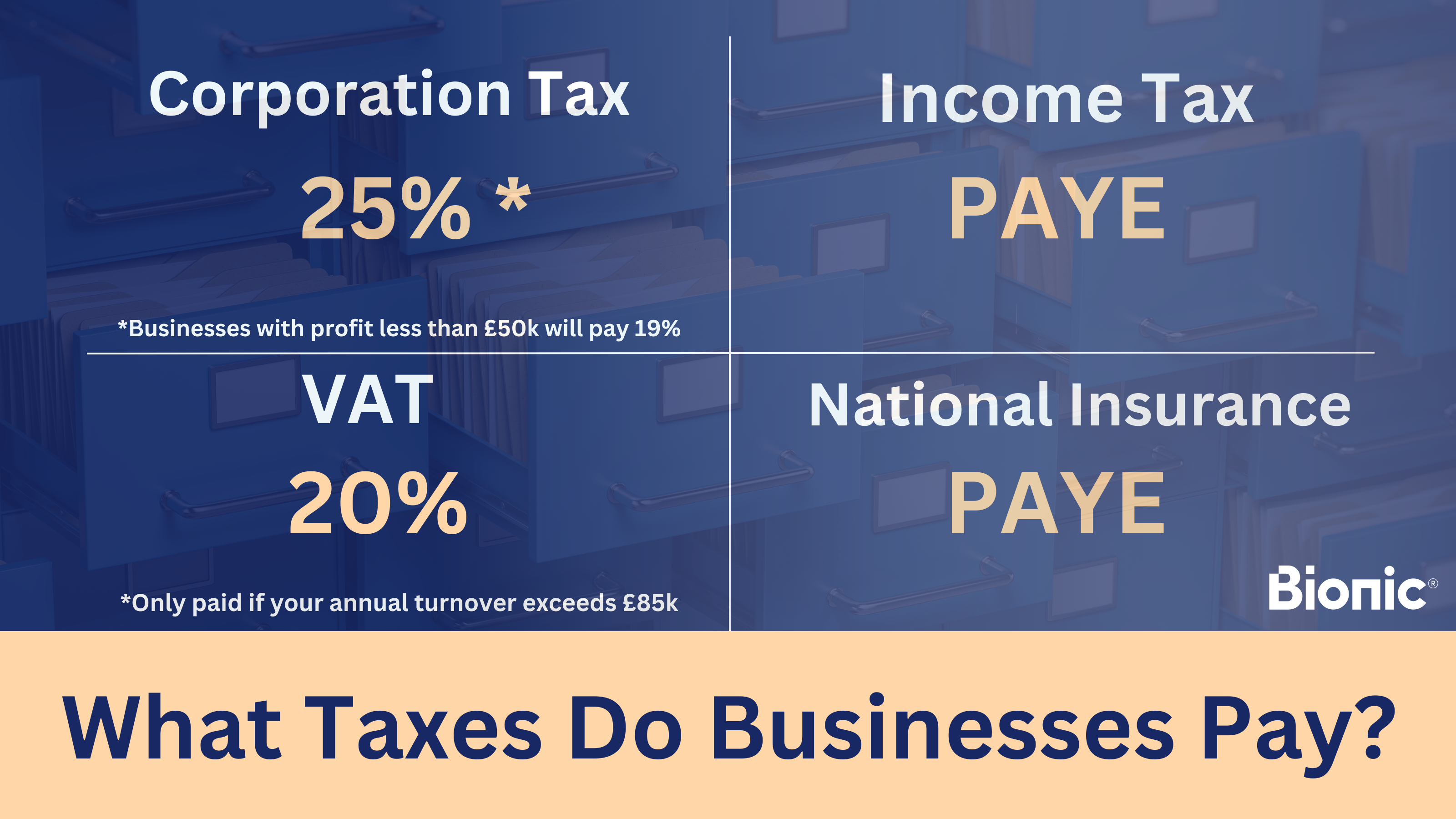

- VAT - Value Added Tax (VAT) is paid by any company in the UK with an annual turnover of more than £90,000. However, you can register for VAT even if your revenue is below that threshold. VAT is paid quarterly to HMRC.

- Corporation tax - The current main rate of Corporation Tax is 25% on company profits, as of April 2023 (previously 19%). But, you may be able to claim 'Marginal Relief' if your business has taxable profits of less than £50,000, meaning you could still pay the 19% rate (small profit rate). Check the government website for information on allowances and reliefs. Corporation tax must be paid within nine months of your company’s financial year-end.

- Payroll - Your company payroll is the sum of all your staff wages and tends to be a monthly expense.

- Rent - Unless you own your business premises, you will have to pay rent to your landlord. Most landlords will charge monthly rent, though you could agree to quarterly or annual payments.

- Other unforeseen bills - All businesses incur other regular costs, some of which can result in yet more monthly bills. For example, this will apply if you have hired some of your equipment or bought it on a finance deal.

What to do if you can’t pay your VAT

If you can’t pay your quarterly VAT bill, there are options available to you.

HMRC will allow some companies to pay off their tax or VAT arrears through a series of monthly payments, as part of a ‘Time To Pay’ arrangement (TTP). However, you will only be allowed to set up a TTP if HMRC believes your company will ultimately pay off its debt in full, and even then it will last for a maximum of 12 months.

If you cannot secure a TTP, then you might want to consider a business finance arrangement to cover your costs in the short term. A tax finance deal - or tax advance loan - is a type of loan that can be taken out to spread the cost of your tax over several months.

VAT finance is just one type of tax advance loan and may be available to your business if you can’t afford your VAT bill.

What happens if you can’t pay your income tax bill

Just as with an unpaid VAT bill, HMRC may be able to offer a TTP arrangement if you can’t afford your income tax bill. But again, these are discretionary and will not be offered in every circumstance.

If you need help paying your taxes - any sort of taxes - then you can contact Citizens Advice for impartial, practical advice on what steps are available to you.

Taking out a short-term loan to finance a tax bill is an option for most UK businesses. Business finance loans are designed to help you pay your tax bill, but these may not be suitable for every business or every situation.

What to do if you can’t pay your corporation tax

If you are a limited company and cannot pay your corporation tax, the first thing to do is to contact HMRC. Corporation tax is due nine months and one day after your company’s tax year comes to an end, so the quicker you let HMRC know you cannot pay it, the more likely they are to help you find a solution.

For those worried about the timescale for paying corporation tax, it could be that a tax finance loan could be an option . Tax loans are a type of business finance that helps cover short-term cashflow issues when your tax bill is due. However, this type of financing may not be suitable for a business that is concerned about ever being able to pay an outstanding tax bill.

How to finance your VAT and tax bill or VAT and tax arrears

There are plenty of ways a business can fund a tax bill or any other HMRC debt, and a tax bill loan is one of the most common.

It is relatively straightforward to get a business VAT loan. Most lenders will give you an answer very quickly after your initial application to help you avoid late payment fees.

As with any business financing, how much you can borrow will depend on things like the size and turnover of your company, how large your tax bill is, what sector you work in, and how well established your business is.

If you cannot access finance for your HMRC debts, there may still be other tax bill payment options available to you. You may be able to negotiate with HMRC over a VAT delayed payment, for example, especially if you are able to pay some of the debt immediately.

What business loans are available for business tax or VAT bills?

If you are worried about paying your taxes late or fretting over the possibility of a missed VAT payment, there are still solutions to help keep your finances on track even if you are certain you can’t pay your tax bill on time.

More and more lenders are offering short-term business loans to help those struggling to pay their taxes. Some of these are even offered on an unsecured basis.

You can apply for a VAT or other tax loan quickly and easily, getting a quote within days. And even if that’s not the right option for your business, other financing deals are available. You may be able to arrange a bridging loan with your bank or a business overdraft.

As with all business financing options, shop around and seek expert advice wherever possible.

Do you pay VAT on a business loan?

No. Business loan repayments are outside the scope of VAT, so you don’t pay any when you take one out, which means VAT is not charged on loan interest.

What is a VAT loan?

If your business is VAT registered, it will need to pay a quarterly VAT bill. A VAT loan is a type of short term borrowing where the money is used to pay this quarterly VAT bill. When taking out a VAT loan, the lender will usually pay the loan amount directly to HMRC and you'll then make monthly repayments to the lender.

How can I apply for a tax business VAT loan?

Applying for a VAT loan does not have to be complicated. First, it’s advisable to get in touch with an agent who can help you find a lender, like us here at Bionic - or go directly to your bank. A VAT loan is a secured business loan, so you must secure assets as security against it.

There are no ‘set standard criteria for VAT loans’ but lenders will usually want to look at the following: turnover and loan amount, trading history, credit rating and whether the business owner is a homeowner.

The time it takes to secure a loan really depends on the lender chosen, but if your application is approved the lender will pay the amount to HMRC and the money could be in your bank after 24-36 hours.

As with any loan, you’ll need to pay it back. This can be arranged to suit your business but is usually paid in instalments over a set period. You will have to pay back the loan amount, plus the interest on top. The interest you pay will be agreed prior with your lender.

What are the current UK VAT rates for businesses?

The current rate of VAT in the UK is 20%. Some goods and services, such as children's car seats and home energy have a reduced rate of 5% VAT. Most food and children's clothes are exempt from VAT.

VAT is charged at 20% on business energy, but there are some exceptions. For more information, check out our guide to VAT and business energy bills.

You can only charge VAT if your business is registered for VAT.

If your business is VAT registered, it must charge VAT on goods and services. It can also reclaim any VAT it has paid on business-related goods or services.

VAT is charged on most goods and services, which are known as taxable supplies, examples include:

- Business sales, which are any goods or services your business sells

- Hiring or loaning goods to someone

- Selling business assets

- Commission

- Items sold to staff, such as canteen meals

- Business goods used for personal reasons

- 'Non-sales’ like bartering, part-exchange and gifts

Why use Bionic for business finance?

At Bionic, we know business finance inside out. Our team of experts can find you the right type of financing for whatever situation you find yourself in, whether you are unable to pay your VAT or any other tax bill.

Using our sophisticated, market-leading technology, we will scour offers from hundreds of lenders and get you the best deal available to help you keep your business going. We can also help with other business essentials, including business gas, business electricity, business insurance and phone and broadband.