* By submitting your details you agree to our terms and conditions and privacy policy . We promise we won’t share your data with others for marketing purposes.

Compare quotes and protect your small business

A legal requirement if you have employees

Protect against claims due to staff injuries or illnesses

Bionic is the comparison site for your small business

We compare a vetted panel of trusted business suppliers

Bionic provides business insurance for Limited companies, sole traders, partnerships & more

Get tailored cover to protect your wallet against unexpected legal costs or compensation

Get the protection you need with no unnecessary extras that you don’t want

What is...

employers' liability insurance?

Employers' liability insurance is essential for any business with employees and is a legal requirement in the UK. It covers claims made by staff for workplace-related injuries or illnesses and will help towards compensation claims, legal fees or medical bills if your business is at fault.

Without it, your business could end up covering these costs – even for claims made by former employees.

Who needs employers’ liability insurance?

Employers' liability insurance is legally required for most businesses in the UK that employ staff, including full-time, part-time, temporary workers, apprentices, and even volunteers or interns. If you’re a sole trader without any employees, you may be exempt. Always check with your insurer if you’re unsure.

Small to medium businesses

Whether you run a small high street shop, salon or anything in between - you'll need the right coverage. This helps protect against claims from employee injury or illness caused by the work they carry out for you.

Limited companies

If you're a larger enterprise with any employees, including limited companies you're likely to have many employees. The right level of insurance helps protect against employee claims for injury or illness as a result of the work they do for you.

What does employers liability insurance cover?

Employers' liability insurance could cover the cost of compensation if an employee becomes ill or is injured as a result of carrying out work for your business. Coverage varies per provider and package. Always check your policy details to see what is covered in your policy. It can help in the following circumstances:

Workplace injuries

If an employee slips, trips, or falls while at work

Occupational illnesses

Illnesses caused by workplace conditions, like hearing loss from loud environments

Accidents outside the workplace

Injuries sustained while performing work duties off-site

Long-term conditions

Chronic injuries or illnesses that develop over time, like repetitive strain injury (RSI) (even for ex-employees).

Legal costs

Fees for defending claims, regardless of whether the claim is upheld

Employer’s liability insurance is a legal requirement for many businesses. It can help protect your wallet, so you may not have to pay out if an employee claims against you

James Barwell – Insurance Director

How much is employers’ liability insurance?

The cost of employers’ liability insurance cover varies depending on several factors unique to your business, including:

- Type of business - High-risk industries like construction or manufacturing typically have higher premiums than lower-risk businesses such as retail or office-based work.

- Number of employees - The more employees you have, the higher the risk and the cost of coverage.

- Claims history - A history of claims can indicate higher risk, leading to increased premiums.

- Workplace risks - Businesses with hazardous working environments or specialized equipment may face higher costs.

- Policy coverage level - The industry standard is £10 million across the insurers we deal with. Any additional cover will influence the price.

To find out exactly what it’ll cost to insure your business, speak to a member of our insurance team today!

What if you have volunteers? Our Business Comparison Expert, Les Roberts, explains more.

How Bionic business insurance comparison works

Compare insurance quotes in three simple steps

1

Start your quote online

Speed up the process by submitting basic business details online – whenever you have time.

2

Speak to our UK-based team

Schedule a call with one of our insurance brokers to discuss the details to ensure they’re correct.

3

Compare tailored quotes

Get your quotes from our panel of trusted insurers and through any questions with our team.

What do I need to get started?

You only need a few details to get started with getting a business insurance quote online, so it’s best to have the following information ready to go:

Your business name and trade

Your policy start date

Your name and contact details to receive your quote options

You may be asked additional questions about business activities

Employers' Liability Insurance FAQs

Our team shares essential knowledge on business insurance and employees

Employee injury at work: A complete guide for UK small business owners

Knowing how to handle a workplace accident and your key responsibilities can be challenging. Find out more about employee injury at work and how to prepare with our guide.

UK health and safety for small business owners in 2025/26

Discover how to easily protect yourself and your employees by understanding the latest Health & Safety regulations and implement effective safety procedures at work.

UK business licences 2026: what do you need for your business?

Not all businesses need a licence, but it helps to know if you do need one before you start trading. Find out what business licences you need and other considerations by business type in our guide.

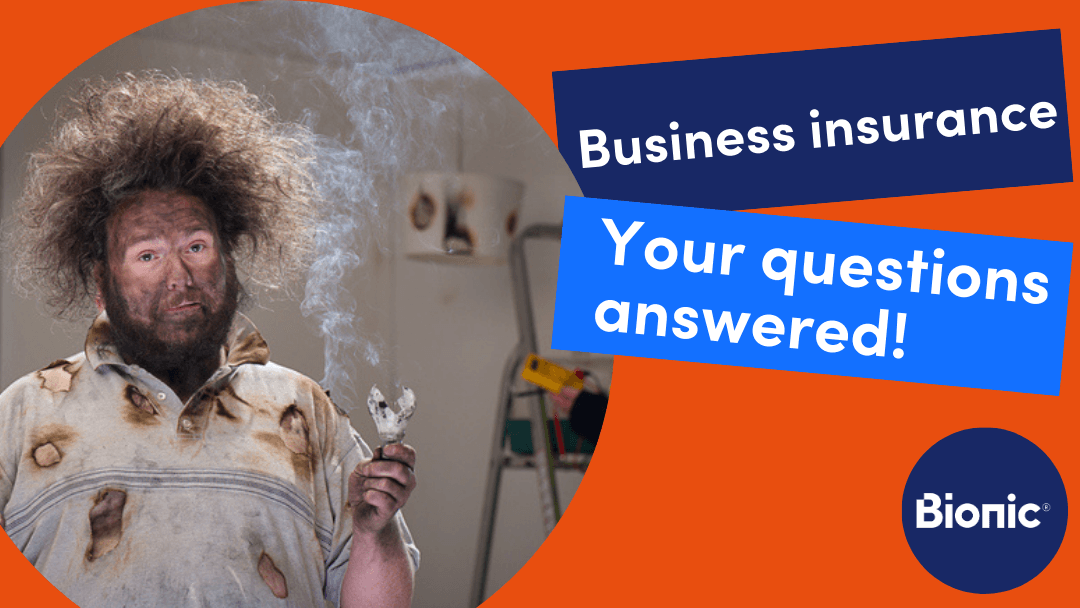

Business Insurance FAQs: Your most asked questions, answered by our insurance team

Charlie & Les talk through everything you need to know about business insurance cover so you can make an informed decision for your business.

Not your usual boring business content!

Sign-up to The Backbone, our free fortnightly newsletter for anyone who owns, runs, or works in one of the millions of businesses across the UK. Get the inside track from real business owners just like you