Business advice: 5 common mistakes to avoid when selecting business insurance

Do you know which business insurance policies are a legal requirement and which are not?

Are you aware of the value of business interruption insurance for small businesses? These are just some of the questions you should ask yourself when arranging insurance for your small business.

No one wants to spend their Friday afternoon sorting out cover — but by neglecting it — things can easily go wrong! To avoid a business insurance horror story, learn the 5 common mistakes when selecting business insurance and educate yourself on how it works by reading our handy guide.

Do small businesses need insurance?

Yes — two types of business insurance are a legal requirement in certain circumstances:

- Employers’ liability insurance - If you have one or more employees who are not immediate family members.

- Business motor insurance - If you use a vehicle for business purposes.

While other types of insurance aren’t a legal requirement, some are essential. Any small business with a store should consider taking out public liability insurance as a minimum. This covers your back in case a customer injures themselves on your property and they make a claim against you.

While business interruption insurance is key for protecting your income or profit in case disaster strikes and, for some reason, you can’t operate.

Why is it important to select the right business insurance?

Mistakes and accidents are bound to happen when running a small business, no matter what type of business you own. For example:

- A new employee gives out the wrong legal advice to a client, which they action

- A supplier provides you with a faulty pet toy which causes dogs to choke

- A customer gets a nasty face rash after you dye their hair

- A bad storm damages your electricity, and you can’t operate your business

Having the correct cover limits in place protects you against unexpected risks and reduces the likelihood you’ll have to pay anythingof having to pay more than an excess if you have to claim. Policies vary per insurer, and limits and exclusions always apply.

If you have a broker and insurer on board, they can help deal with the paperwork and claims process so you can focus on the day-to-day running of your business without having to worry about paying out large sums or even ending up in court.

Having sufficient cover gives you peace of mind and protects employees, partners, customers and your business.

What happens if you have the incorrect business insurance?

According to Allianz, 51% of businesses have stopped buying at least one type of cover. And if you don’t even take out the legal requirements, let alone the essential cover you might need for your business — you risk being uninsured.

So if you need to make a claim on your business insurance policy — or a claim is made against you — you might not be covered. This could leave you having to pay out compensation, legal fees or more from your own pocket.

Depending on your business — suppliers, partners or clients may not work with you if you don’t have the right cover in place in case something goes wrong. It’s a risk some just aren’t willing to take!

Can you cancel your business insurance?

It's important to note that each insurer and policy is different so you need to check your policy wording to see if you can cancel your contract. Watch our video below where our Insurance Team Leader, Charlie Hart has more information.

5 common mistakes to avoid when choosing business insurance

Whether you’ve just started a microbusiness, or been running a SME for a while – make sure you don’t run into these mistakes when it comes to selecting your business insurance.

Not assessing business risk properly

When it comes to risks — not understanding the full extent of them in your business could end up costing you in the long run.

Every risk should be assessed, identifying the hazards and who might be harmed, and putting in place precautions to limit risks.

Risk assessments are a legal requirement; not only do you need to know the scope of risks across your business for insurance purposes, but also in the interest of public health and safety.

If you don’t know the scope of the risks, you may inform your insurer incorrectly and, therefore, risk being underinsured. Even worse, if a claim is made against you, you might not be protected because you don’t have the right cover.

Imagine you run a grocery store, and after three years of trading, you run into a really bad storm and your roof leaks and damages hundreds of pounds worth of stock. You look to claim on your insurance policy, but when an inspection is carried out, you learn that part of your roof is flat and made of timber. You’re told your insurance policy is void because you didn’t declare that your roof is flat or made of any material other than concrete. You are then left to foot all the costs yourself — and your insurance policy is voided.

It’s key you declare the correct details to your insurer broker to avoid issues down the line. See our detailed guide to risk management for small businesses.

Choosing cover only based on price

We know business owners love a deal — but when it comes to insurance, price isn’t the only thing you should consider. If you do a quick check online for a business insurance quote, chances are, you’re not getting an accurate quote that will sufficiently cover your business.

Every business is unique — down to trade, number of employees, building and location. That’s why you need to go through a number of questions with a broker to ensure your cover meets your needs.

At Bionic, we don’t compromise on quality when arranging business insurance. While we want to help you get the best deal, we also want to make sure our customers are sufficiently insured.

Start a quote online today and our knowledgeable insurance team will be on hand to help guide you through the process.

Not checking documentation

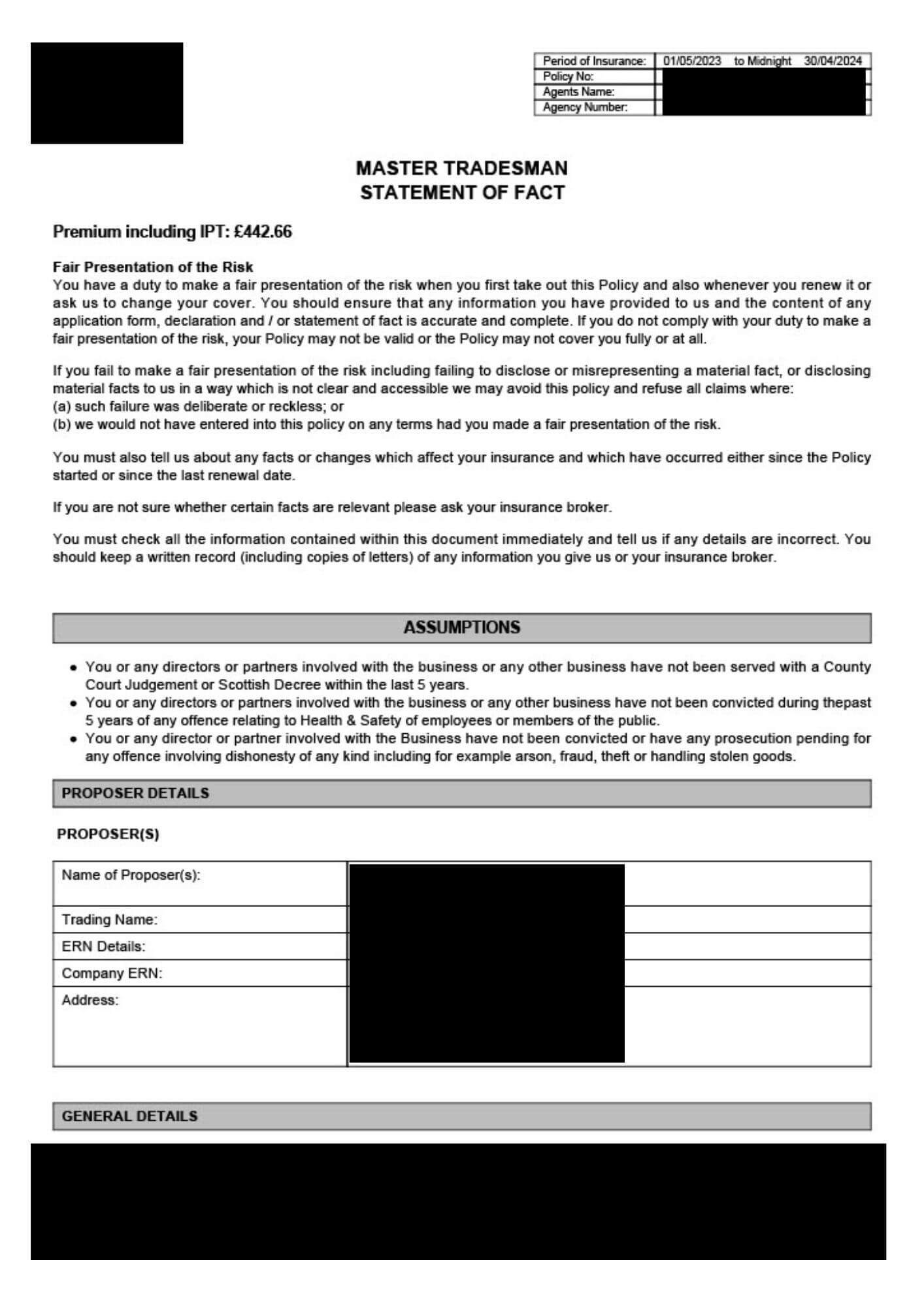

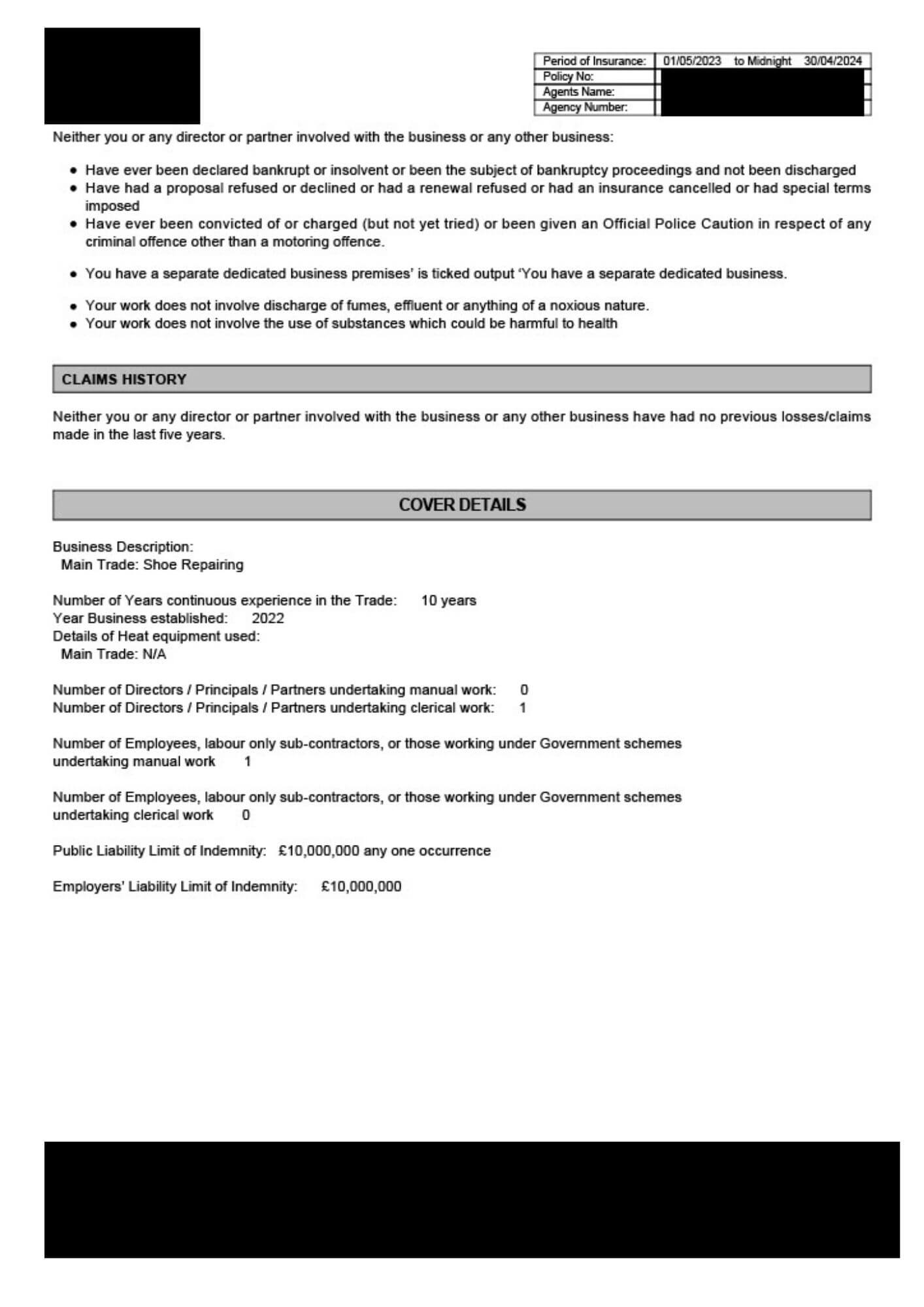

When you organise your business insurance, you’ll be sent a number of documents from your broker and/or insurer. No one likes to read the fine print, but it’s important you check everything you’ve stated and your policy is correct.

As part of this, your broker should send you a ‘Statement of Fact’ document, which includes everything you have stated including claims history and company details. You will also receive a policy schedule which includes – excesses and optional extras, exclusions and limits.

Example of a statement of fact letter in insurance

Below is the start of a statement of fact letter, including the business details declared and cover details. The full document is normally several pages long and is sent via a PDF to you after organising your insurance.

When checking your statement of fact letter, if you spot something is incorrect — tell your broker immediately. Remember, if your business details aren’t correct and you need to claim — you risk your policy being void.

Ignoring the reputation of insurance providers

There are so many insurance providers out there — how can you be sure you can trust them? At Bionic, we work with large insurance providers, but also small specialist providers — but we only work with providers we trust.

Before agreeing to a contract with a provider — whether using Bionic or not —- it’s best to check the reputation of the insurer. You can check business insurance reviews on sites like Feefo, and Trustpilot but also industry-specific platforms like defaqto (financial services).

And if you’ve never heard of them or you’re hesitant, speak to your broker to learn more about them to put any worries at ease.

Reviewing your business insurance without a broker

Brokers tend to get a bad rep — but most of them do have good intentions and want to help customers. Brokers are knowledgeable, know many different insurers and know which questions to ask to ensure you get an accurate quote.

When it comes to renewing your policies, a broker can assess your business needs and talk you through your options.

How often should you review your business insurance cover?

You should review your insurance cover with your broker at least once a year to check it still meets your needs. But you also should review your cover in the event of any of these situations:

- You’ve moved business premises

- Brought on any new suppliers, partners

- Had a hiring spree

- Started new products or serves

What should you do if your business expands?

Growing your business is rewarding! And businesses can expand in different ways — whether that’s hiring more staff or opening up a second shop.

But remember, major business changes can affect the validity of your existing business insurance policy. For example, if you don’t declare you have a second shop, then it won’t be insured at all!

Always contact your broker for help amending your policy to ensure you’re covered as your business grows!

Find more about trade-specific insurance packages, including trade insurance, shop insurance with Bionic today.

How can you find the balance between insurance costs and cover?

Adding more cover to your insurance cover can start to add up in cost. So how can you ensure you’re not overpaying for insurance you don’t need?

As a business owner, we know you’re busy — but educating yourself on the types of business insurance there are is one of the best things you can do to avoid being over or undersold. Once you understand each type of cover, you can apply it to your specific business and see if it needs it.

Speak to a reputable broker for advice on what you need. Many brokers offer business or trade-specific packages designed to make it easier for you to get a quote. But even businesses within the same trade are different so make sure to speak to a broker before buying an off-the-shelf product online.

Avoid mistakes — compare, switch and renew with Bionic

A great price shouldn’t mean quality suffers — our insurance team at Bionic knows how to ask the right questions to find the insurance package that fits. We only work with a panel of trusted insurance providers, so you can relax knowing we’ll get it sorted for you. Find out more, compare business insurance and start a quote online today.

And when it comes to renewing, we can assist you through the process. Bionic also arrange other business essentials, including business energy, business phone and broadband and business loans. Get in touch today and start a quote online.